1. Before you start

Before you can apply for probate using MyHMCTS, you and/or your organisation must have completed other steps:

- Set up a HMCTS Payment by Account (so that you can pay the application fee)

- Registered your organisation with MyHMCTS

- Set up your MyHMCTS user account

Please read the MyHMCTS guidance for further information and instructions. If your organisation has an account already, contact the administrator to arrange for your account creation.

Once you have a MyHMCTS account, you can sign in using your email address and password.

If you need additional help with MyHMCTS email MyHMCTSsupport@justice.gov.uk. We aim to respond within 5 working days.

1.1 If inheritance tax needs to be paid

If inheritance tax needs to be paid:

- send the IHT400 and IHT421 form to HMRC

- wait 20 days before applying for the grant through MyHMCTS

If you do not wait 20 working days, there is a risk of your application being delayed while we wait for the completed IHT421 from HMRC. HMRC will not return the IHT421 to you – it is sent directly to us.

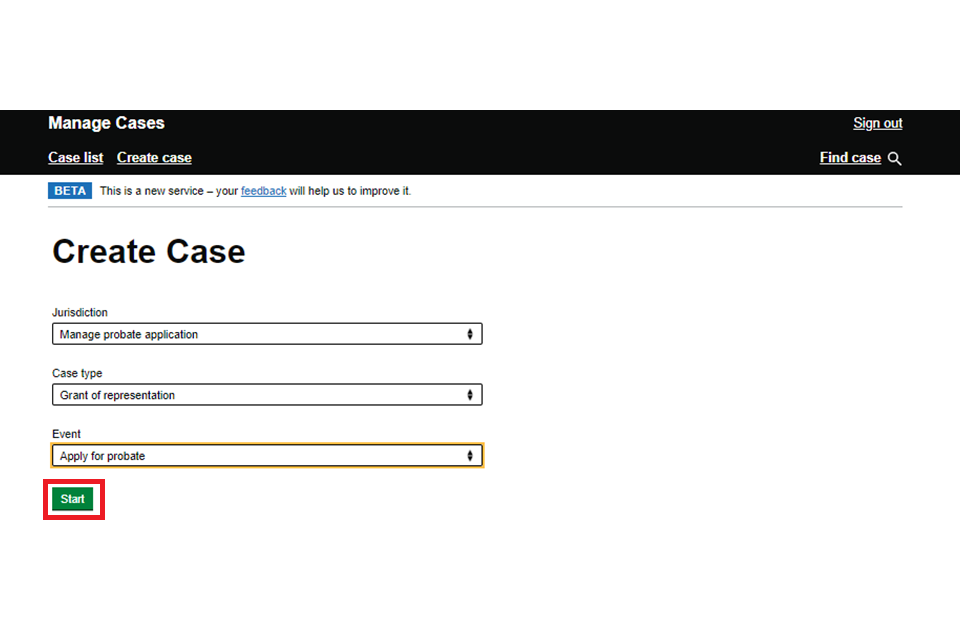

2. Create a case

2.1 Case type and eligibility

1. Once you have signed in, you will see your case list – this will be empty the first time you sign in.

2. Start your application by selecting ‘Create case’.

3. Use the drop-down boxes to select the jurisdiction, case type and event. Once all are selected, press ‘Start’.

4. Before continuing you will see a screen that explains that grant of probate applications must be made online unless certain exemptions apply. It also explains that intestacy and admon will applications can be made online under certain conditions. A link is provided to the paper application guidance, which explains the exemptions and conditions.

The screen also includes information about inheritance tax and when and where inheritance tax forms should be sent.

Check that your application is not exempt and meets the conditions then select ‘Save and continue’.

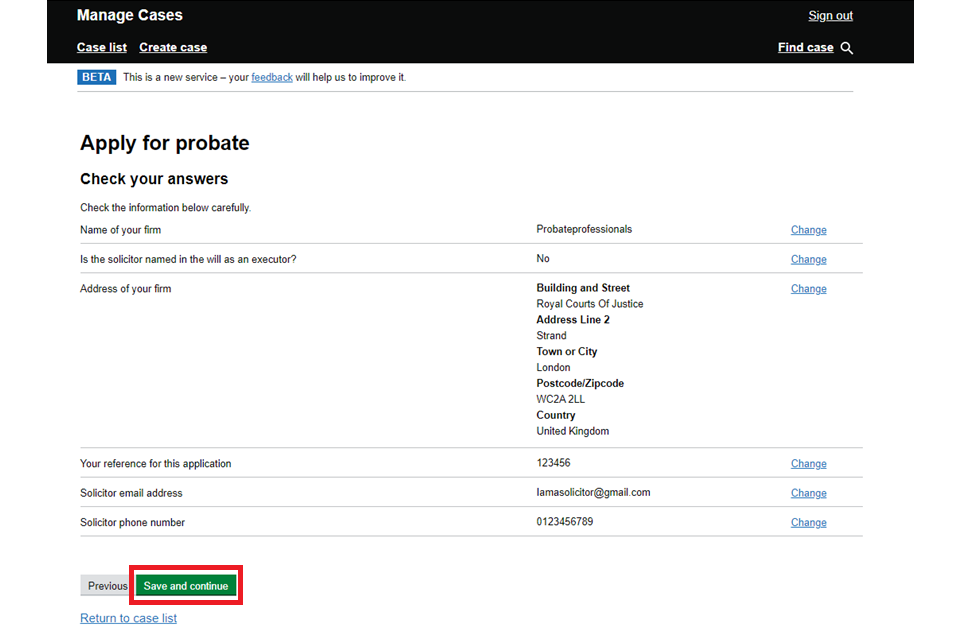

2.2 Your organisation’s details

1. You will be asked to fill out your organisation’s details. If you are the executor, you will be asked to complete additional questions. If you are the executor, the name you provide here must match the name you provide in the statement of truth.

2. You will be asked to check your answers. You will not be able to change these details later, so please review them. When you are satisfied that they are correct, select ‘Save and continue’.

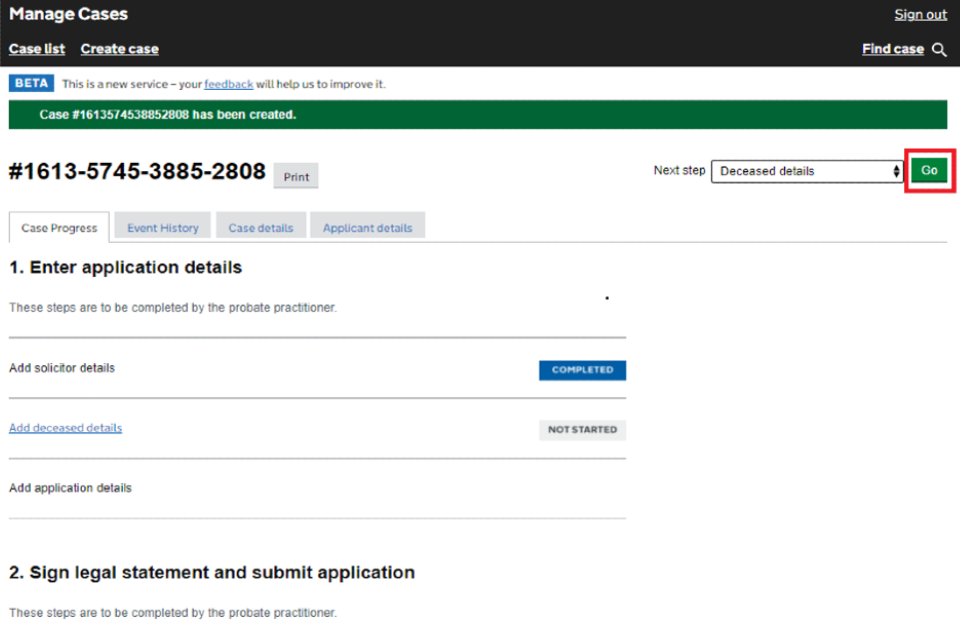

3. You will now see the ‘Case Progress’ showing that you have completed your details. The case has been created but not yet submitted. Select ‘Go’ or ‘Add deceased details’ to continue.

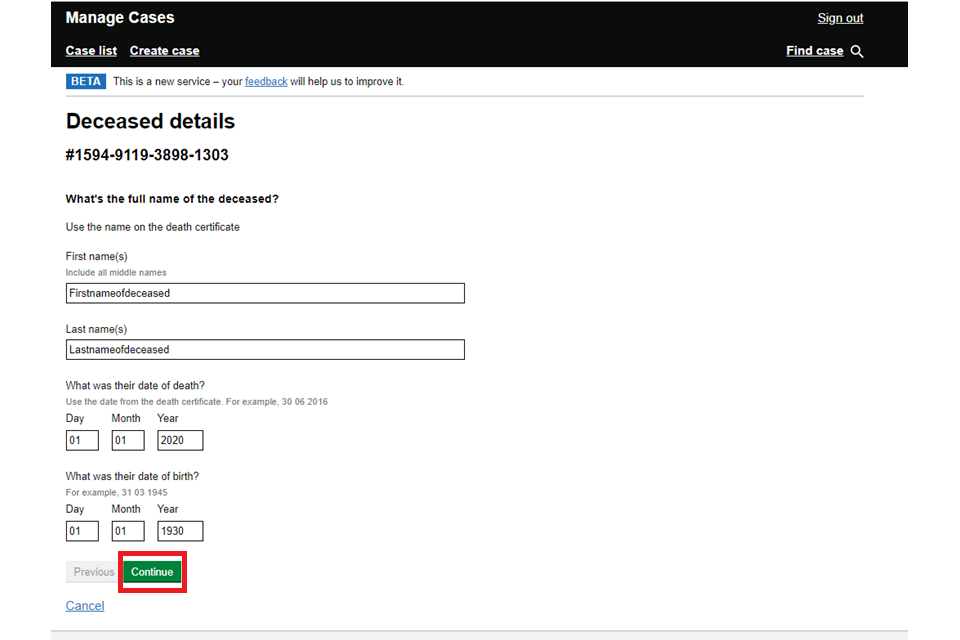

2.3 Deceased details

1. The next set of screens ask for the deceased details. Complete the details on the first screen and select ‘Continue’.

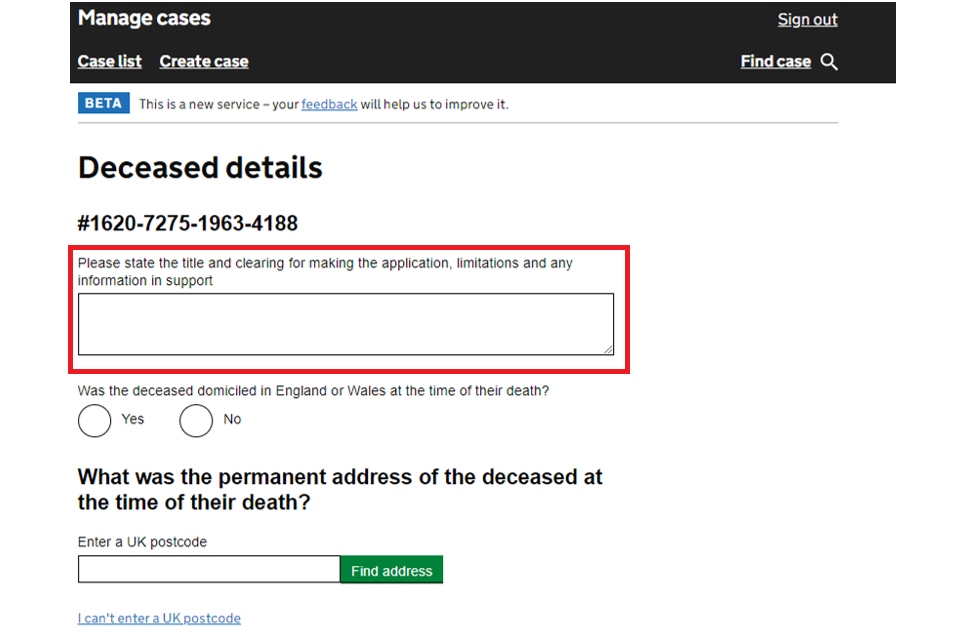

The first section on the next screen asks for the ‘title and clearing for making this application’ – here you should write how you are entitled to apply and why you are applying. Please provide any relevant information that should appear in the legal statement. For example, details of applying for order. In grants of probate this includes information where the executors are partners in a firm or successor firm named in the will.

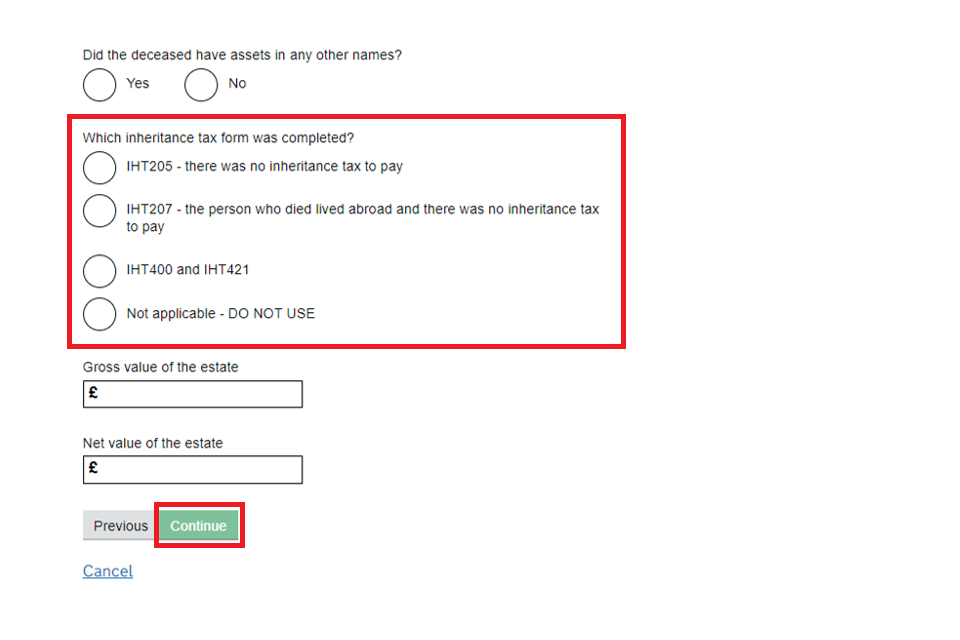

You will also be asked to select which inheritance tax form was completed.

Complete the details and select ‘Continue’.

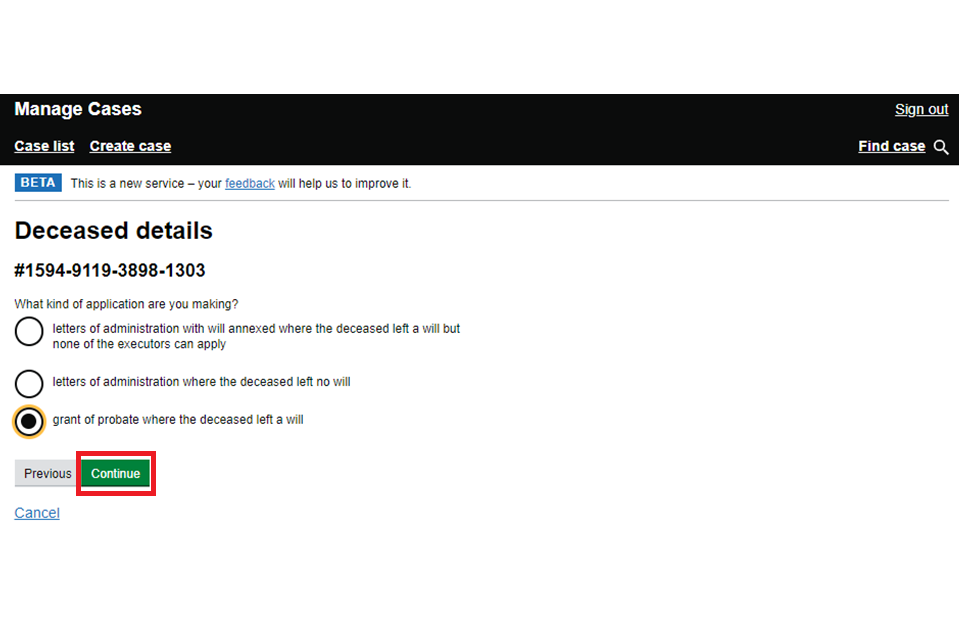

2. You will then be asked to choose the application type:

- letters of administration with will annexed, where the deceased left a will but none of the executors can apply

- letters of administration, where the deceased left no will

- grant of probate, where the deceased left a will

If you are making a grant of probate application, you will be asked 3 questions about the will before continuing.

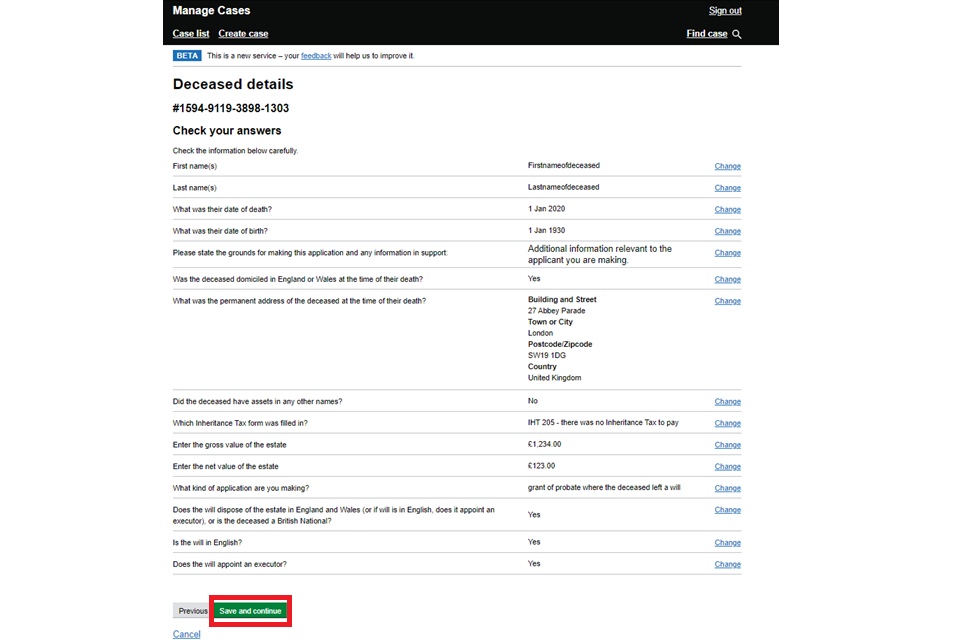

3. You will be asked to check your answers. You can change these details later. When you are satisfied that they are correct, select ‘Save and continue’.

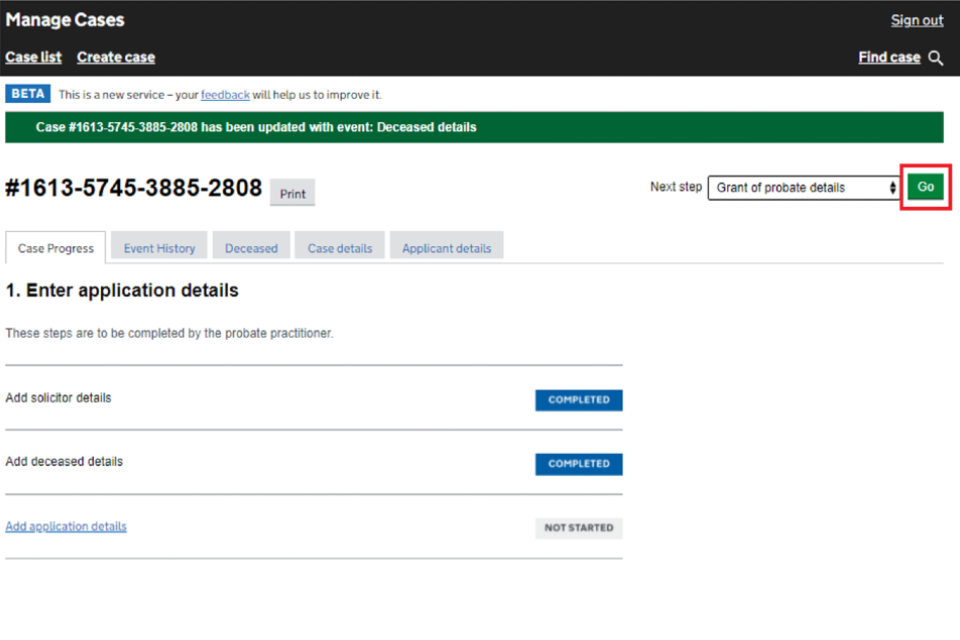

4. You will now see the ‘Case Progress’ showing that ‘add deceased details’ has been completed. The case has been created but not yet submitted. Select ‘Go’ or ‘Add application details’ to continue.

You will now see questions related to the type of application you have selected. Please move to section 3, 4 or 5 of this guidance depending on your application type.

3. Apply with a will (grant of probate)

1. You will be asked if you have access to the will and if there were any codicils added.

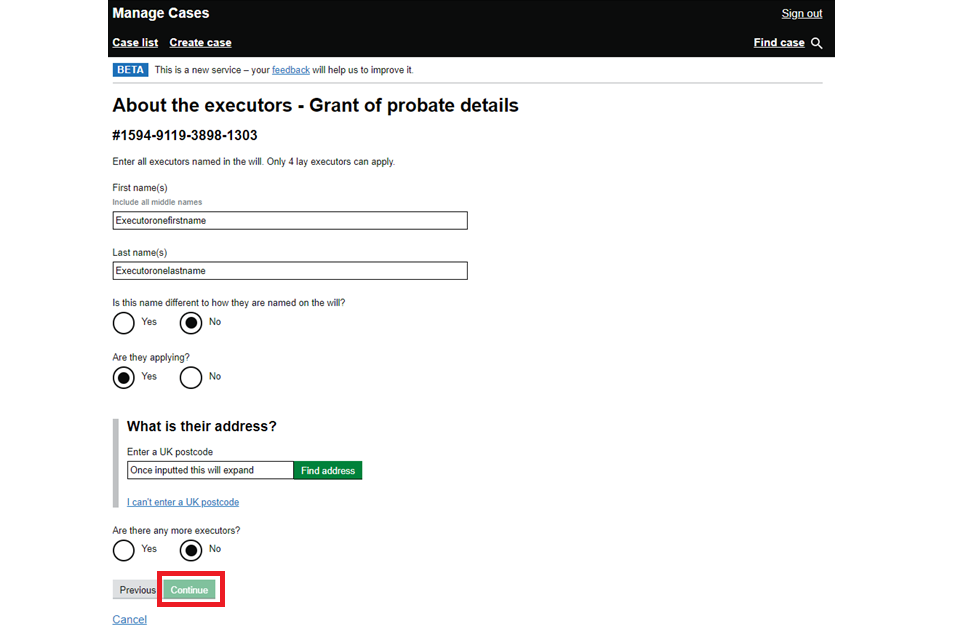

2. You will then need to provide the executor’s details and if they are applying. The questions you’re asked will depend on the options you select. When complete, select ‘Continue’.

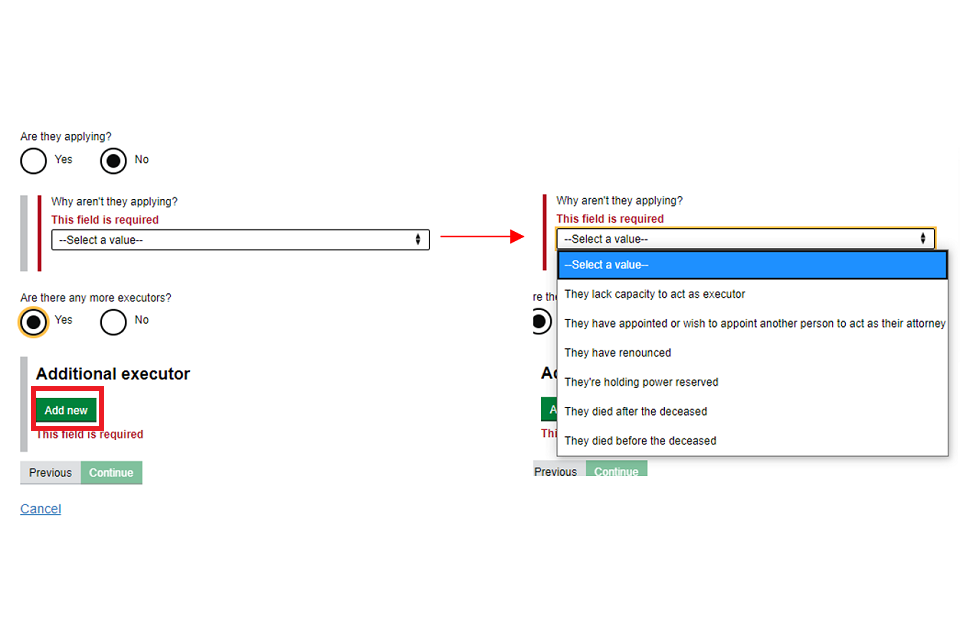

3. If the executor is not applying, you must choose an option to explain why.

4. You can add additional executors if there is more than one.

5. Where executors are partners in a firm or successor firm named in the will, you should:

- add an executor

- choose whether they are applying or not

If applying, fill out the executor’s details with their names – you should have given the necessary information of these applying partners in the ‘title and clearing’ section of step 2.3.1 and stated that power is reserved to the remaining profit-sharing partners in the firm at the date of death.

If not applying, in the ‘first name(s)’ section write ‘remaining profit-sharing partners’ and in the ‘last name(s)’ section write ‘of [your firm’s name] at the date of death’. Successor firms should add ‘which has succeeded to and carried on the practice of [successor firm’s name].

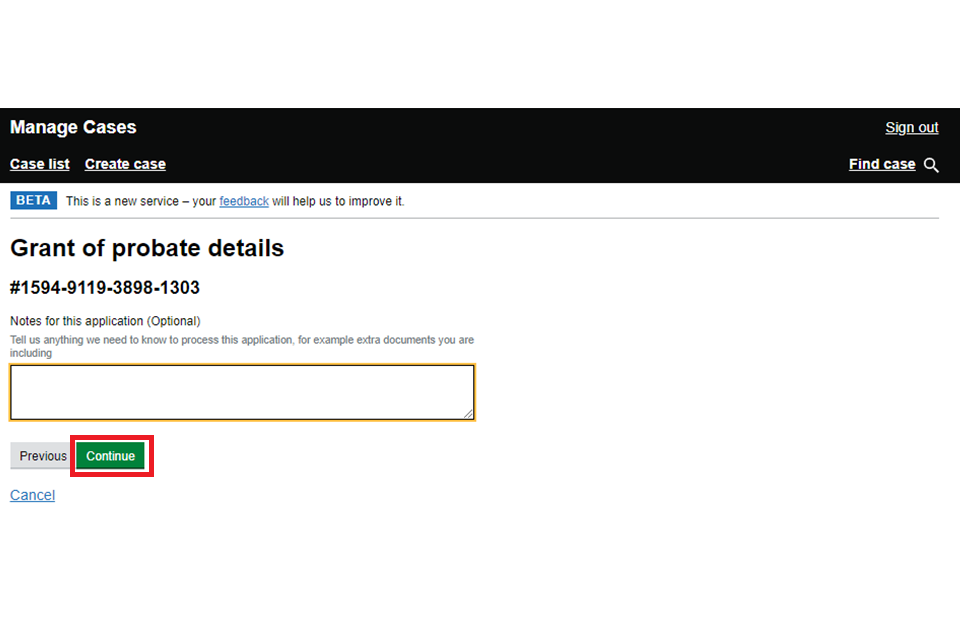

6. Provide notes on other information that does not need to be in the legal statement.

7. You will be asked to check your answers. You can change these details later. When you are satisfied that they are correct, select ‘Save and continue’.

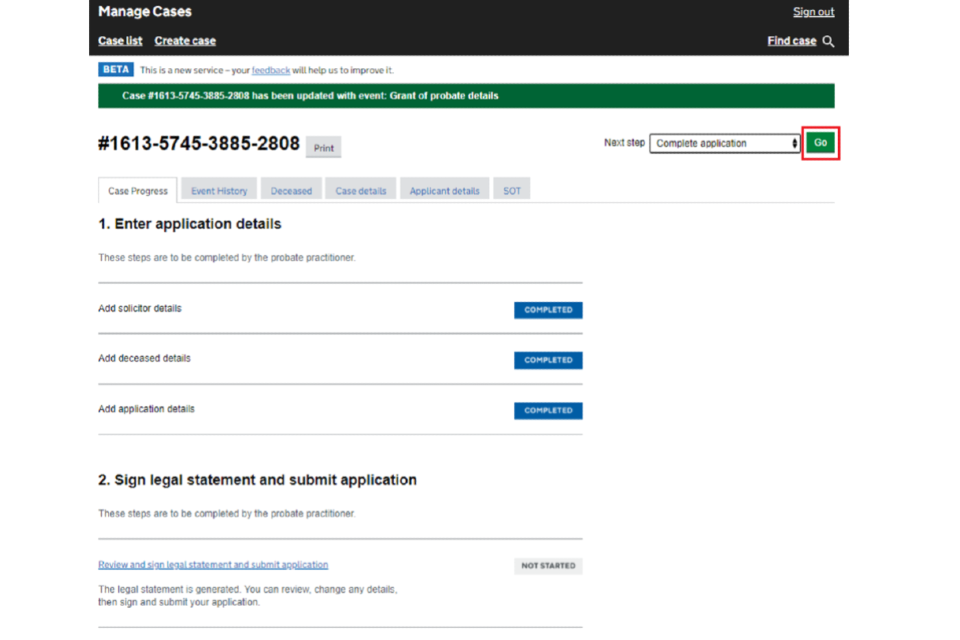

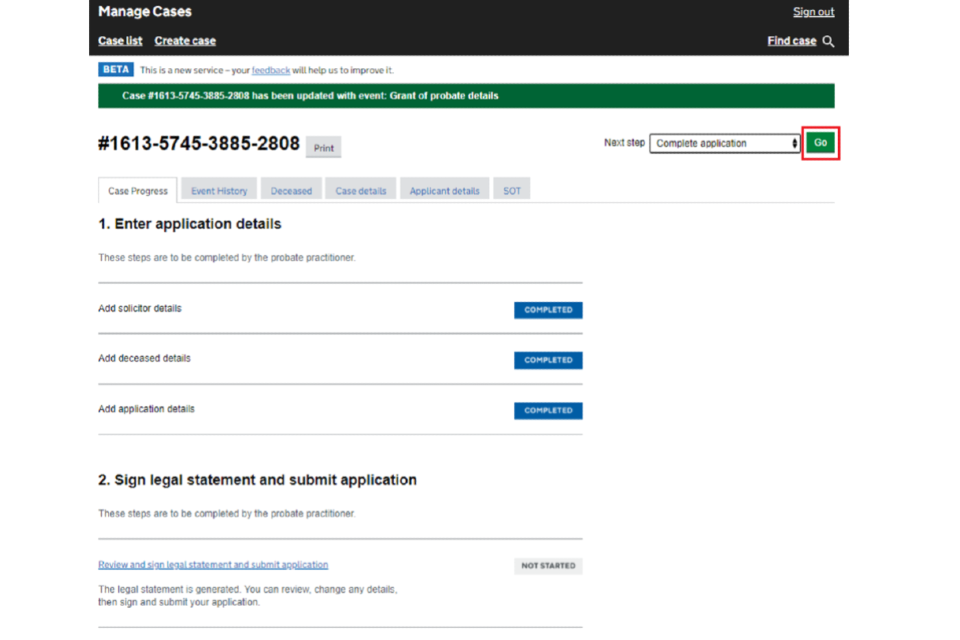

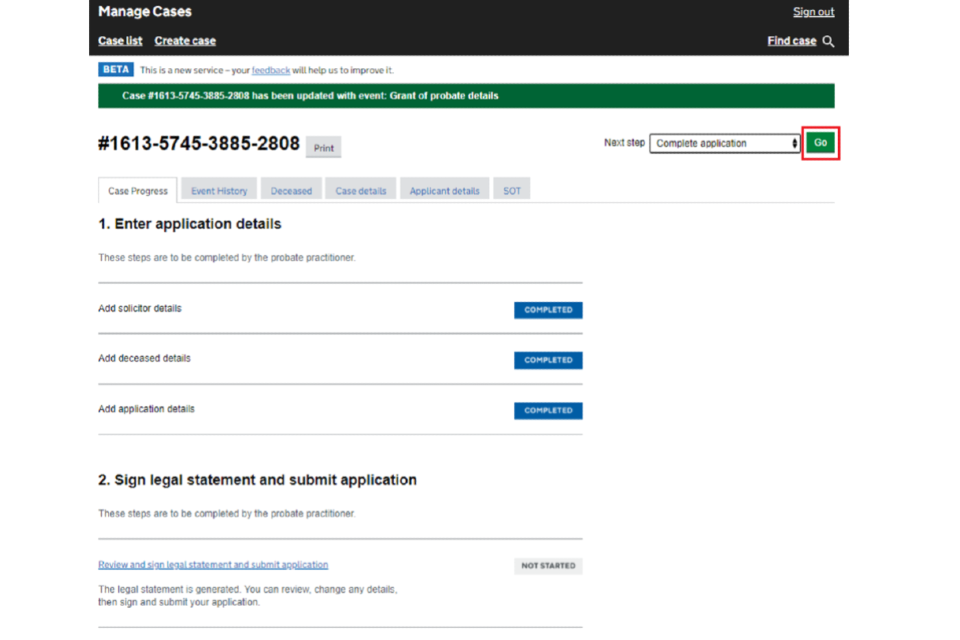

8. You will now see the ‘Case Progress’ showing that the application has been added. Select ‘Go’ or ‘Review and sign legal statement and submit application’ to continue.

You can now move to section 6. Complete your application.

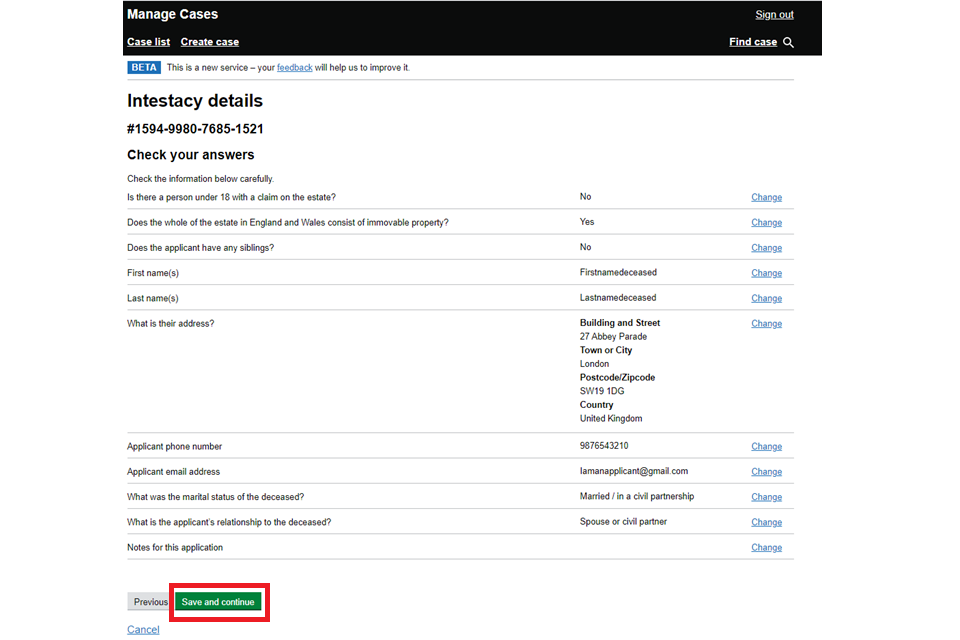

4. Apply with letters of administration – without a will

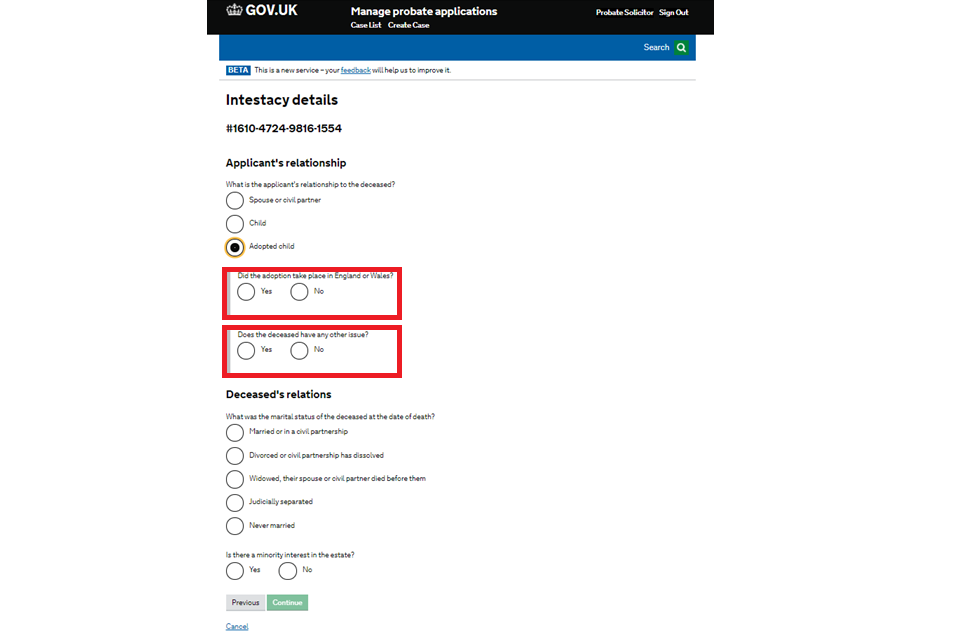

1. You will be asked for information about the applicant – the ‘intestacy’ details.

If the applicant is a child or adopted child and has siblings, you are unable to apply through MyHMCTS and should use the PA1A form.

2. The questions you are asked on the next screen will depend on the options you select. You will only be asked if the adoption took place in England and Wales if the applicant is the adopted child of the deceased. If the applicant is either the child or the adopted child you will also be asked if the deceased had any other issue.

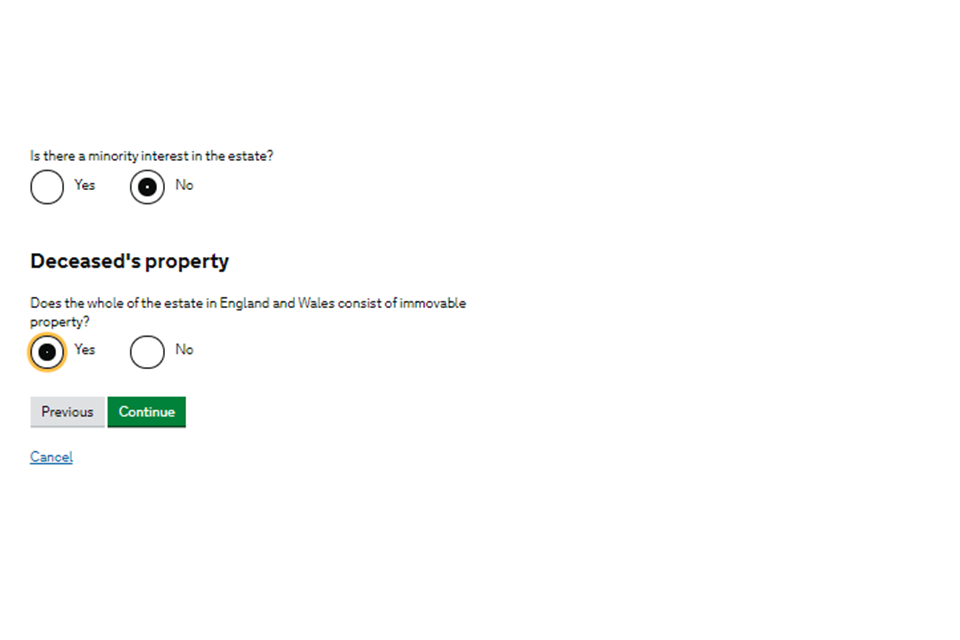

Finally on this screen, if you selected ‘No’ to the question about the deceased’s domicile in section 2.3.1, then you will be asked if the whole of the estate in England and Wales consists of immovable property.

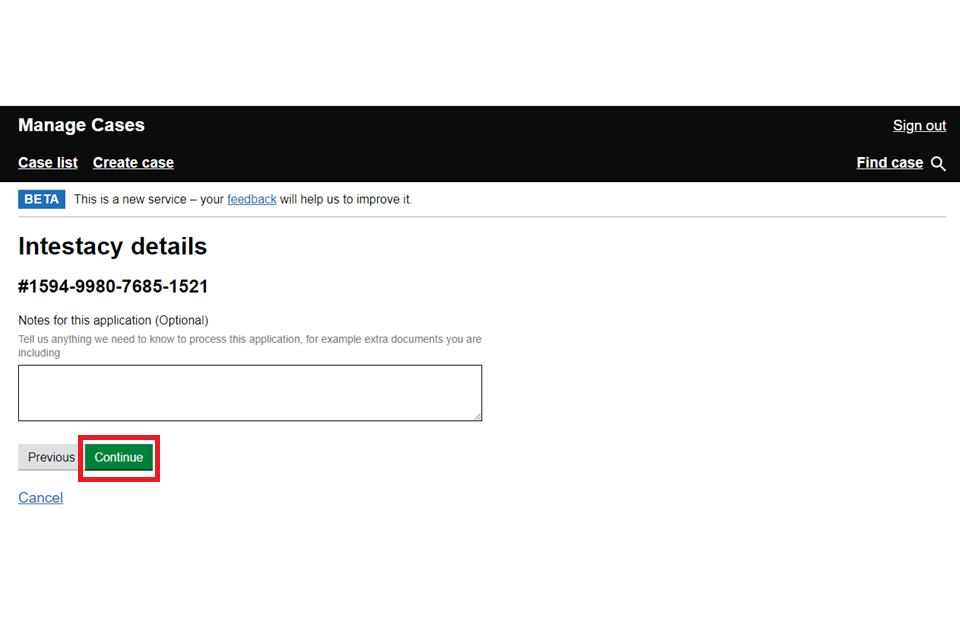

3. Provide notes on other information that does not need to be in the legal statement. Then select ‘Continue’.

4. You will be asked to check your answers. You can change these details later. When you are satisfied that they are correct, select ‘Save and continue’.

5. You will now see the ‘Case Progress’ showing that the application has been added. Select ‘Go’ or ‘Review and sign legal statement and submit application’ to continue.

You can now move to section 6. Complete your application.

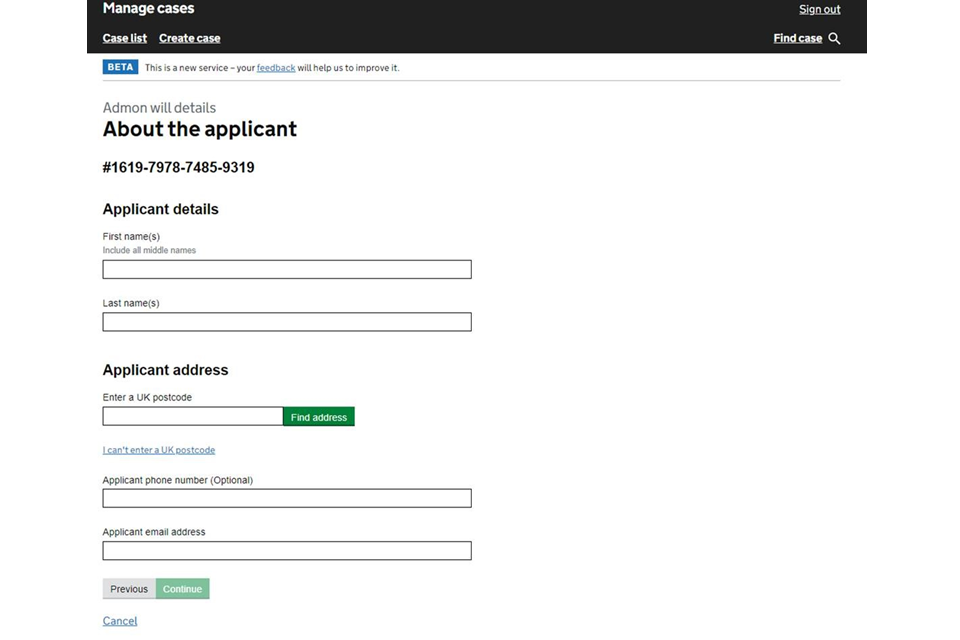

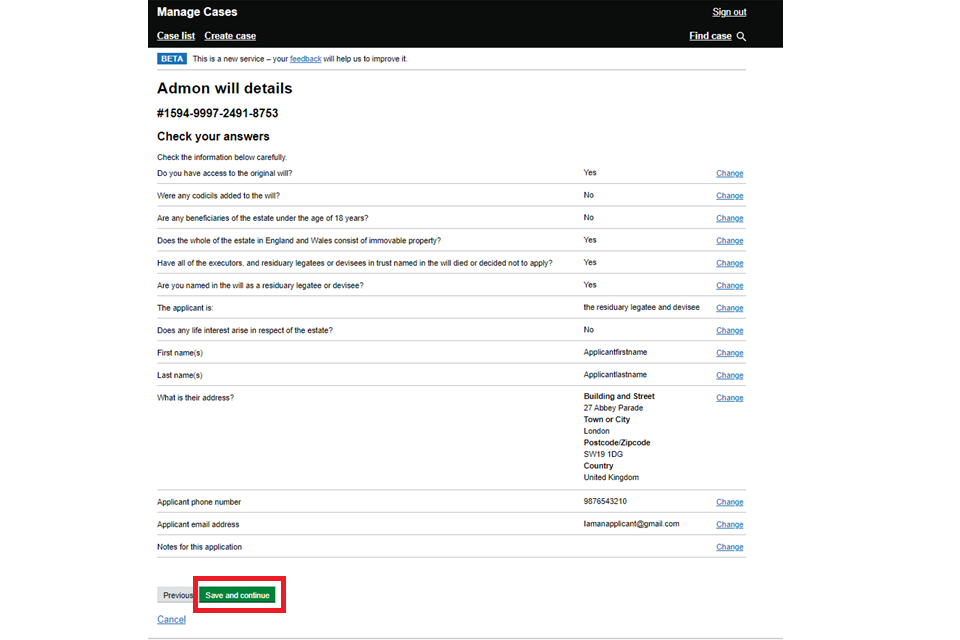

5. Apply with letters of administration – with an annexed will

1. Select whether or not you have access to the will. The questions you’re asked will depend on the options you select.

Select the appropriate options and then ‘Continue’.

2. You will be asked for information about the applicant – the ‘admon will’ details. Firstly you will be asked for their name and address.

The questions you’re asked on the next screen will depend on the answer you gave in the deceased details section about whether the deceased was domiciled in England or Wales at the time of their death. If you answered ‘No’ to that earlier question you will see an additional question asking if the whole of the estate in England and Wales consists of an immovable property. If you answered ‘Yes’ to the earlier question, you will not see the additional question here.

Complete as appropriate and then select ‘Continue’.

3. Provide notes on other information that does not need to be in the legal statement. Then select ‘Continue’.

4. You will be asked to check your answers. You can change these details later. When you are satisfied that they are correct, select ‘Save and continue’.

5. You will now see the ‘Case Progress’ showing that the application has been added. Select ‘Go’ or ‘Review and sign legal statement and submit application’ to continue.

You can now move to section 6. Complete your application.

6. Complete your application

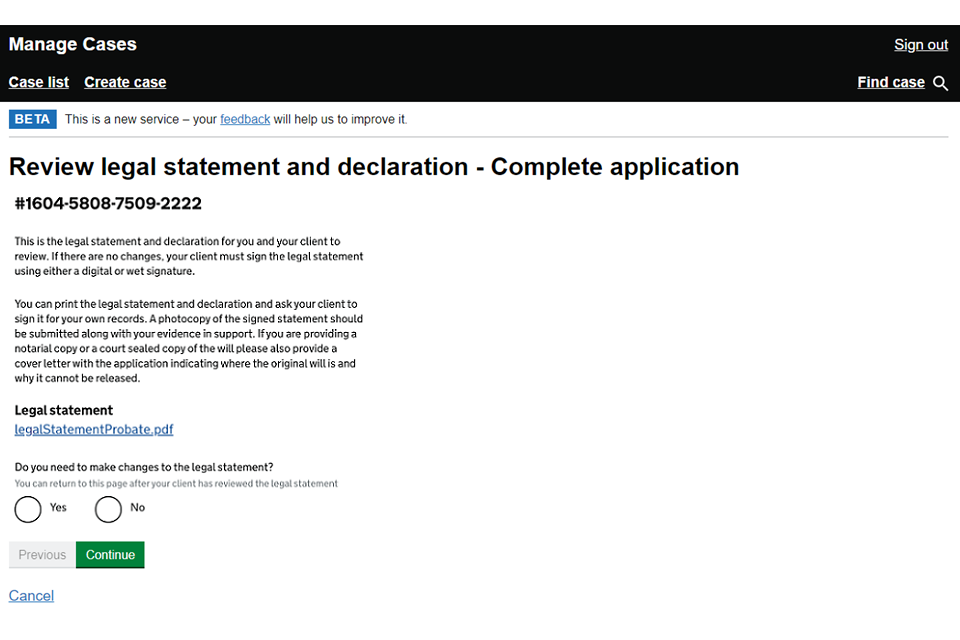

6.1 Legal statement

1. Before completing your application review the legal statement and decide if you need change it. The information in the statement is based on your answers.

If you are satisfied, send this legal statement to your client to sign. Either email the statement to them to add their digital signature or print for them to sign in pen.

You must not confirm that your client has agreed with the legal statement until you and your client are satisfied.

2. Select ‘No’ to changes and ‘Continue’. Go to step 6.3 in this guidance.

3. If you need to make a change, select ‘Yes’ and ‘Continue’. Go to step 6.2 in this guidance.

6.2 Change deceased or probate details

1. You will be asked to select what details you wish to change:

- Deceased details

- ‘Grant of probate’ or ‘intestacy’ or ‘admon’ details

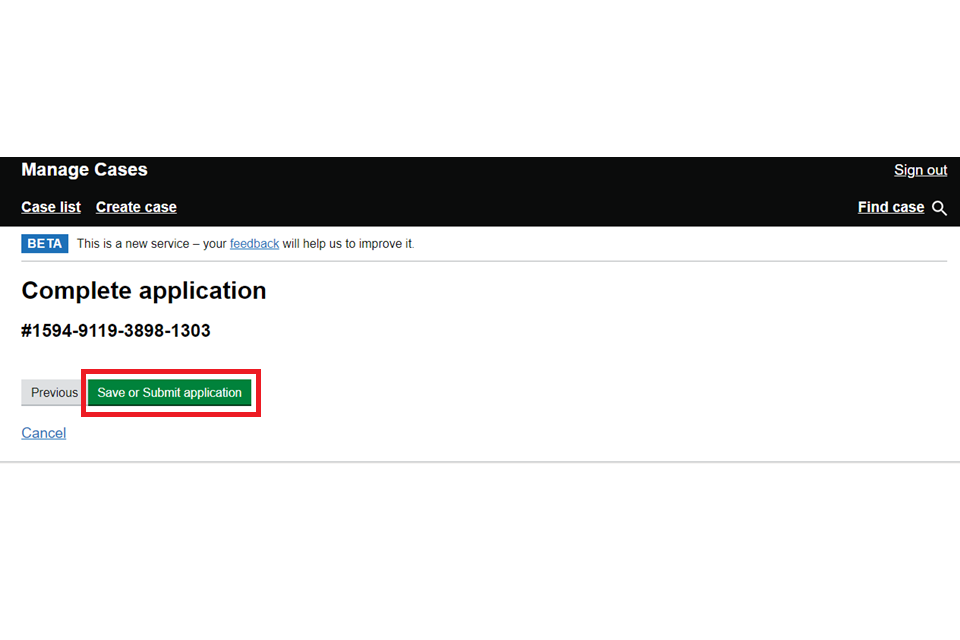

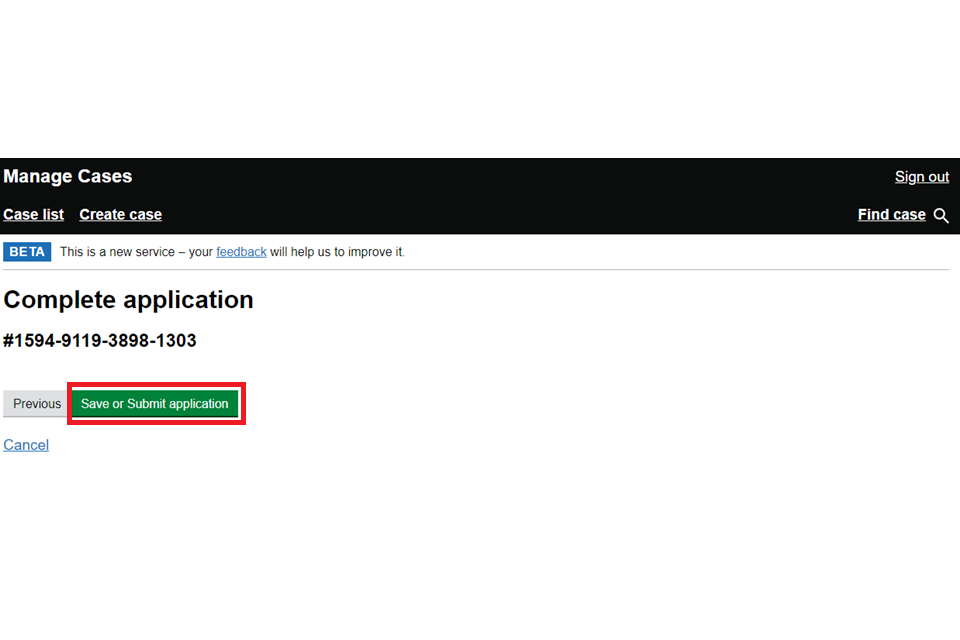

2. Then select ‘Save or Submit application’. The case will not be submitted.

3. You will be taken back to ‘Case progress’. Select ‘Go’ and repeat the appropriate steps to change the information you need to. As you complete each section, they will show as complete.

4. When you return to the legal statement, select ‘No’ and ‘Continue’.

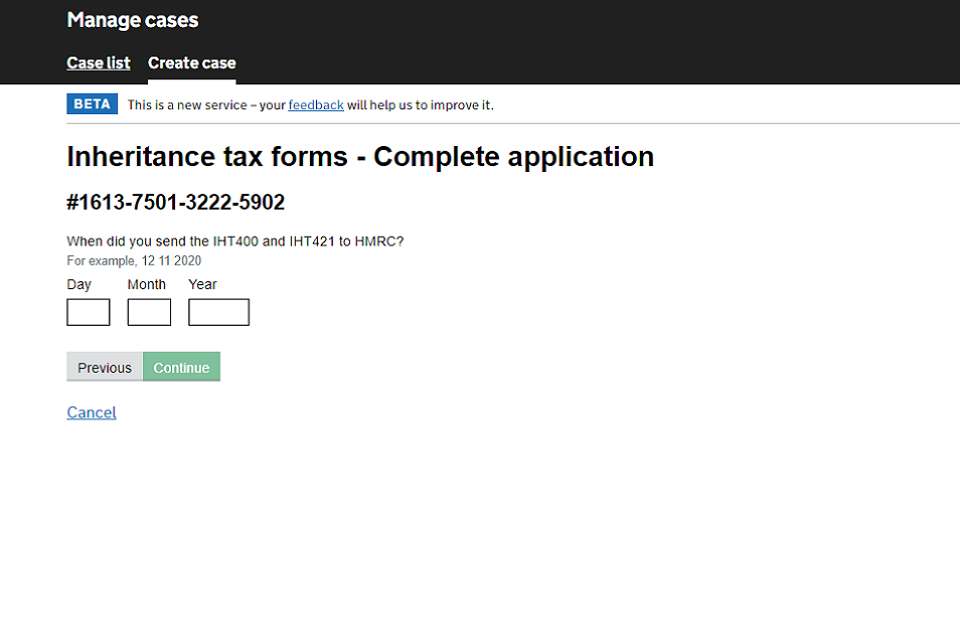

6.3 Inheritance tax, confirmation and statement of truth

1. If there is inheritance tax to pay you will be asked when you sent the IHT400 and IHT421 forms to HMRC. This is to confirm that you have allowed enough time (20 working days) for HMRC to process the forms before you send your application to us. If there is no tax to pay you will go directly to the next step.

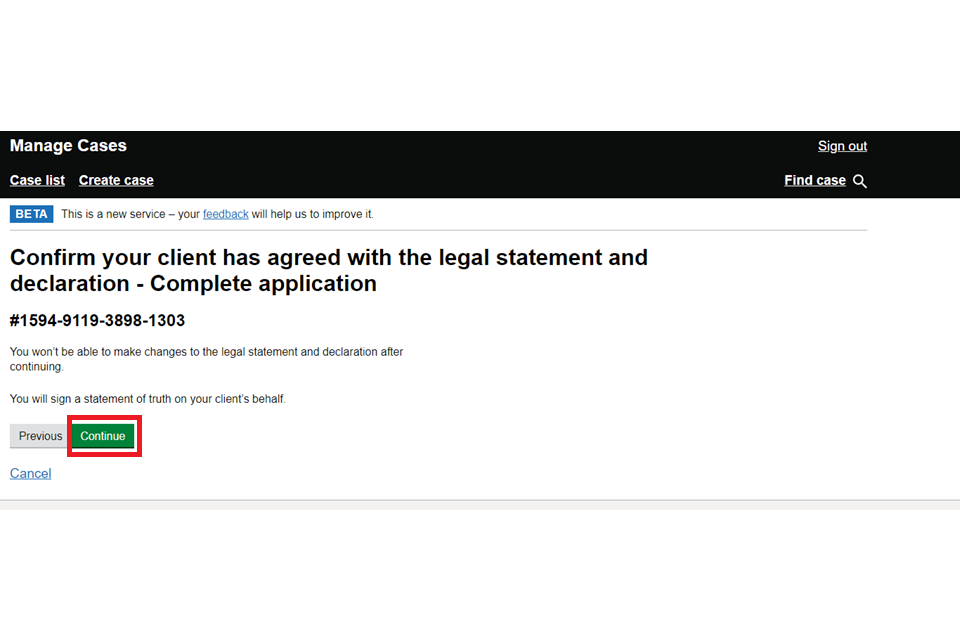

2. You will be asked to confirm that your client has agreed with the legal statement. You cannot change any details or the legal statement after this step in MyHMCTS. If you need to make a change, email contactprobate@justice.gov.uk or call 0300 303 0648.

When ready, select ‘Continue’.

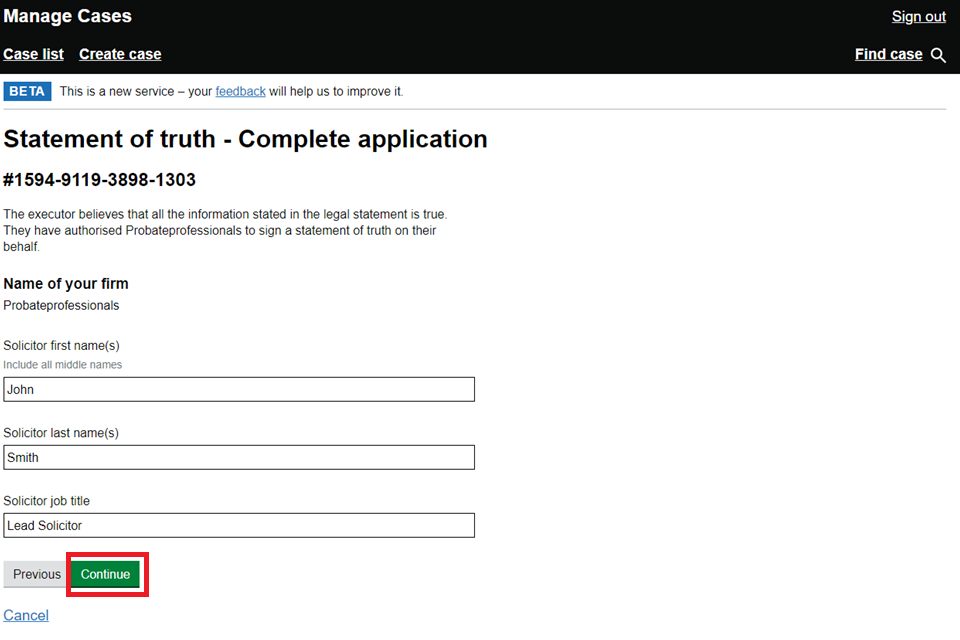

3. You will then be asked to complete a statement of truth. Fill in the information and select ‘Continue’. If you are the executor, the name you provide here must match the name you provide in your organisation’s details.

6.4 Pay for the application

1. The application fee is £155 if the value of the estate is over £5,000.

There’s no fee if the estate is £5,000 or less.

For a second grant in an estate where a previous grant has been issued the fee is £20, even if the estate is £5,000 or less. For cases with a settled land limitation, if the value of the estate is £5,000 or less there’s no fee and if it’s over £5,000 it is £155.

Your client may be eligible for Help with fees. All probate fees are eligible apart from probate searches or ordering copies of a grant of representation.

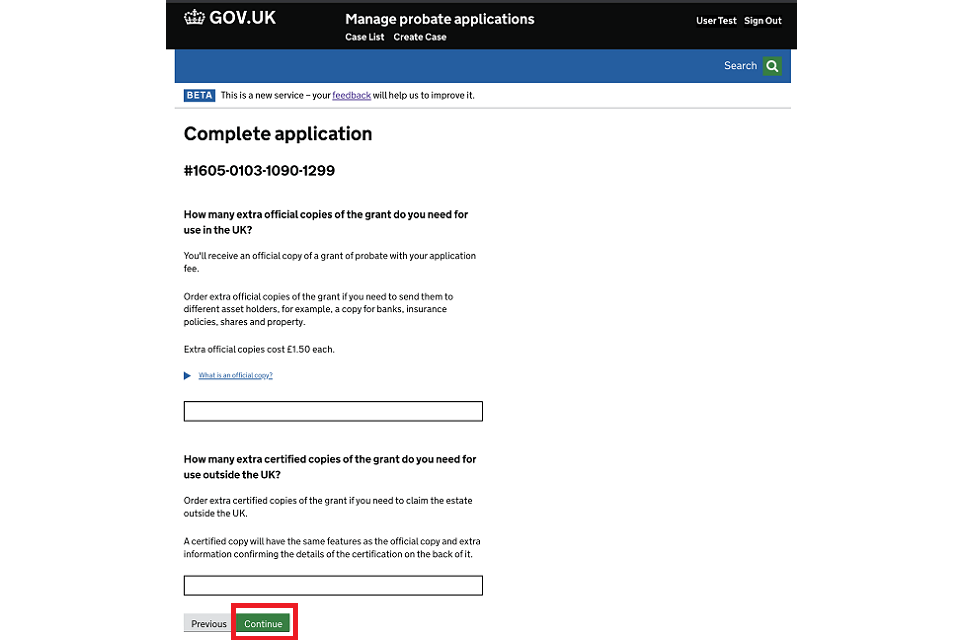

You will automatically receive one free copy of the grant. If you want extra copies tell us how many extra copies you need. Each extra copy costs £1.50. Select ‘Continue’.

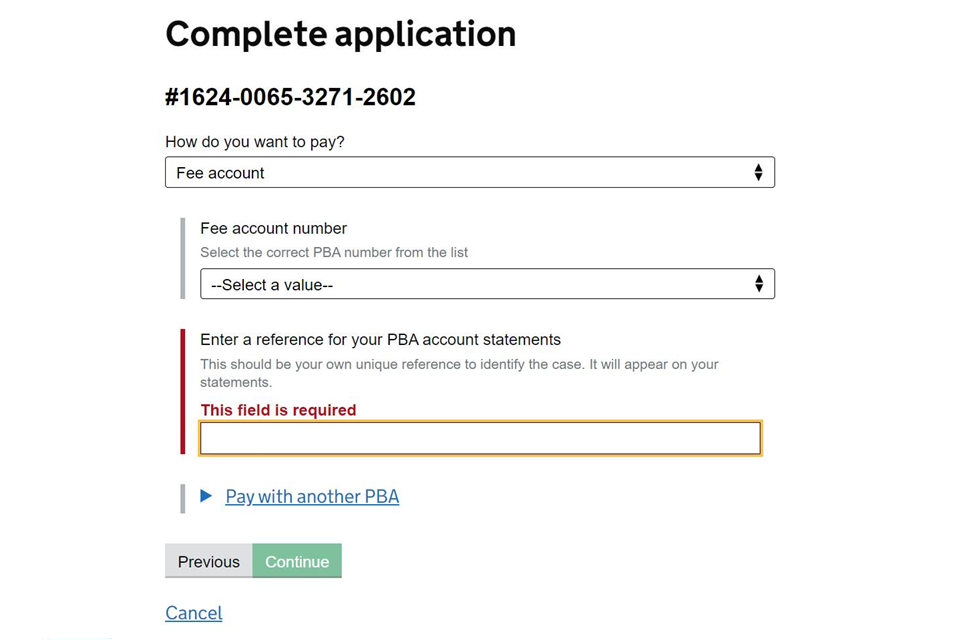

2. You will be asked how you want to pay – you must select ‘Fee account’ from the first drop down list. Your fee account number is the same as your Payment by Account (PBA) number. Select the correct PBA number from the second dropdown list (you may have more than one PBA number) and enter your reference number. Finally on this screen, select ‘Continue’.

3. By selecting ’Save or Submit application’ you will submit your application. Payment will be taken immediately, so your PBA account must have sufficient funds to allow us to take the fee. If not, you will not be able to submit the application and it will be delayed. If unsure, check with your PBA account manager.

6.5 Summary

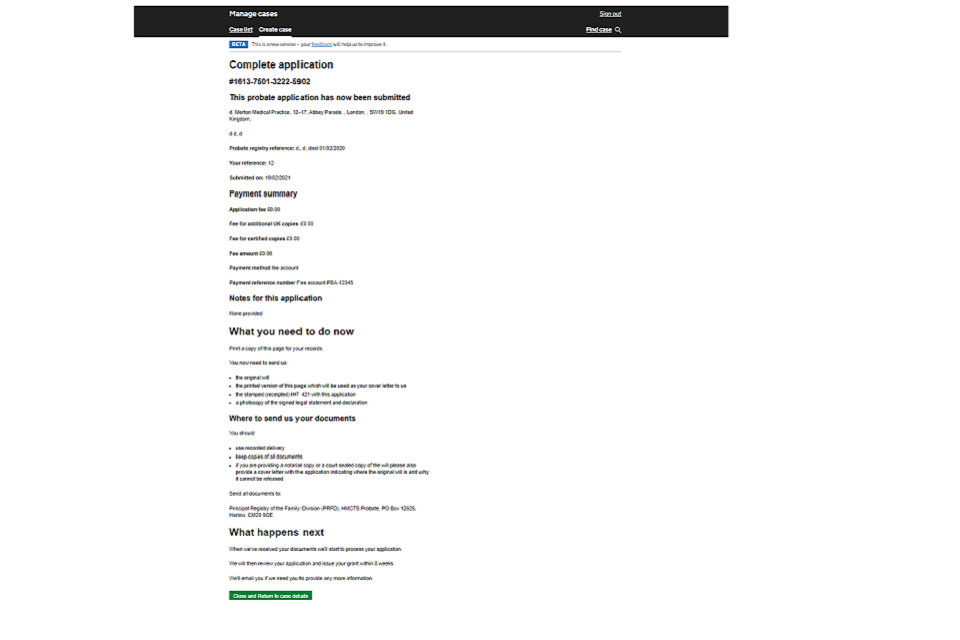

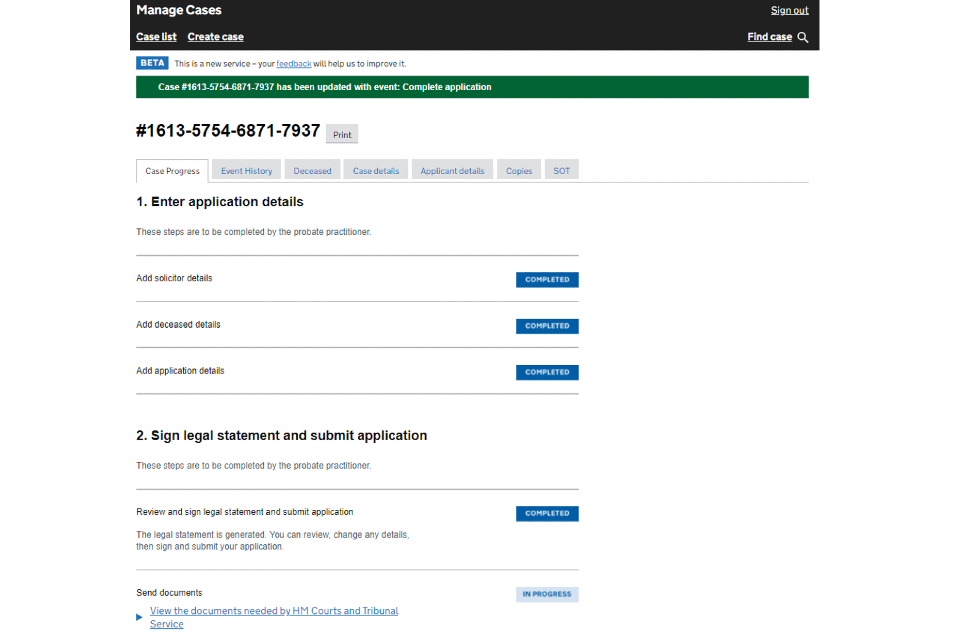

- Once you have submitted your application, you will see a summary followed by information about what you need to do next.

This includes what documents you need to send us and where to send them. Print this page to include as the cover note when you send us your documents. Make a copy of these details as you will not be able to return to this screen once it has closed.

Select ‘Close and Return to case details’.

2. You will be returned to the case details screen. Please now send us the requested documents. If you need a reminder of what to send, select the link under ‘Send documents’.

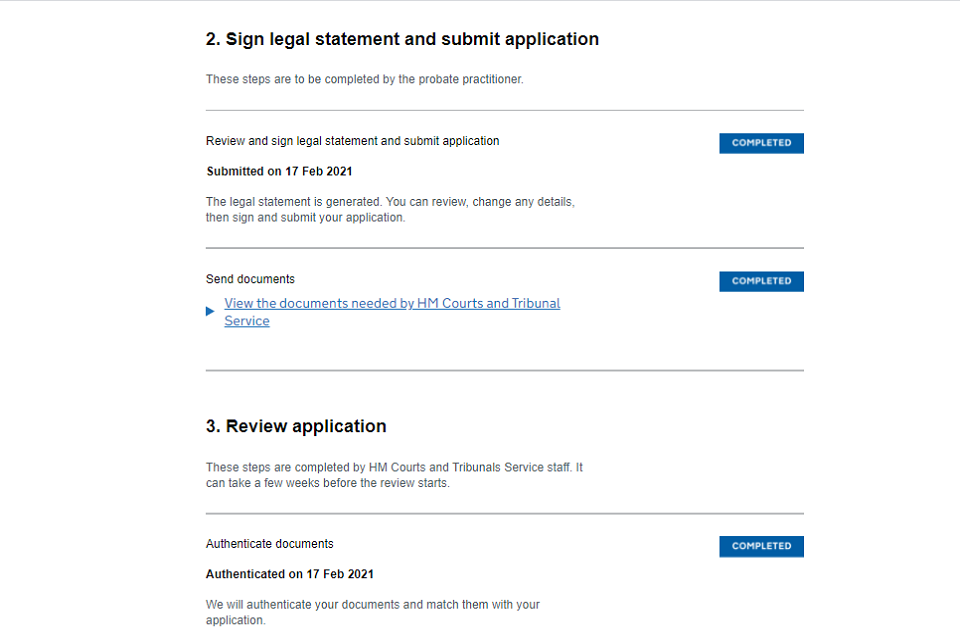

3. When your documents have been received and checked, the ‘Case Progress’ will update to show ‘completed’ for both ‘send documents’ and ‘authenticate documents’. Your application will now be examined by a case worker.

4. Once all checks have been completed and the grant is issued, ‘Grant of representation’ will show as completed. Copies of the grant should be dispatched in the post within 48 hours.

If you have ordered sealed and certified copies of grants for use outside of the UK. These will be received separately to normal grants, and will take longer to arrive.

7. Find and track the progress of your case

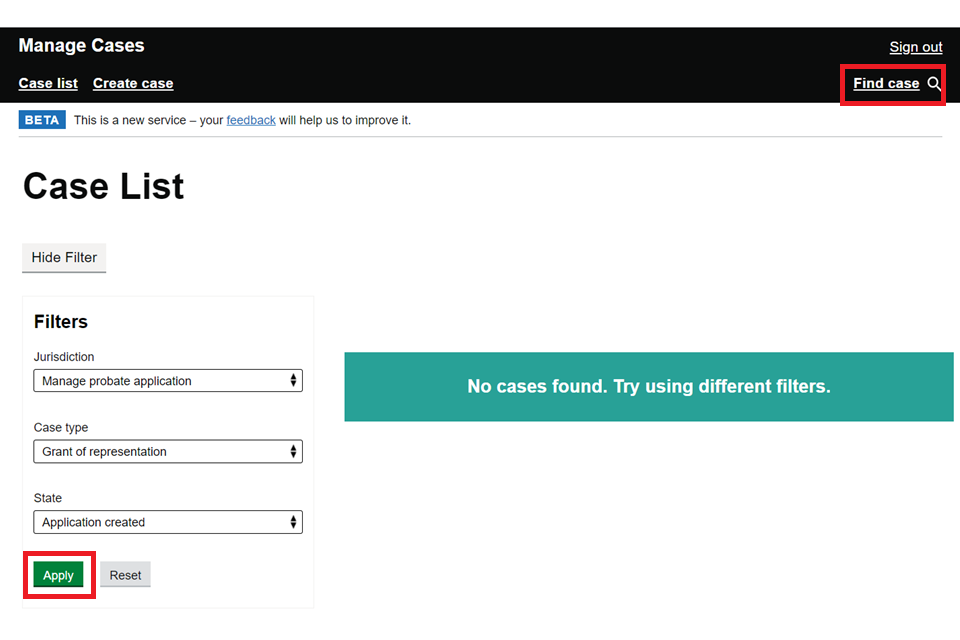

1. To find and track the progress of your application search for it on the ‘Case list’ page.

You can either use the basic filters and select ‘Apply’ or select ‘Find case’ for a more advanced search.

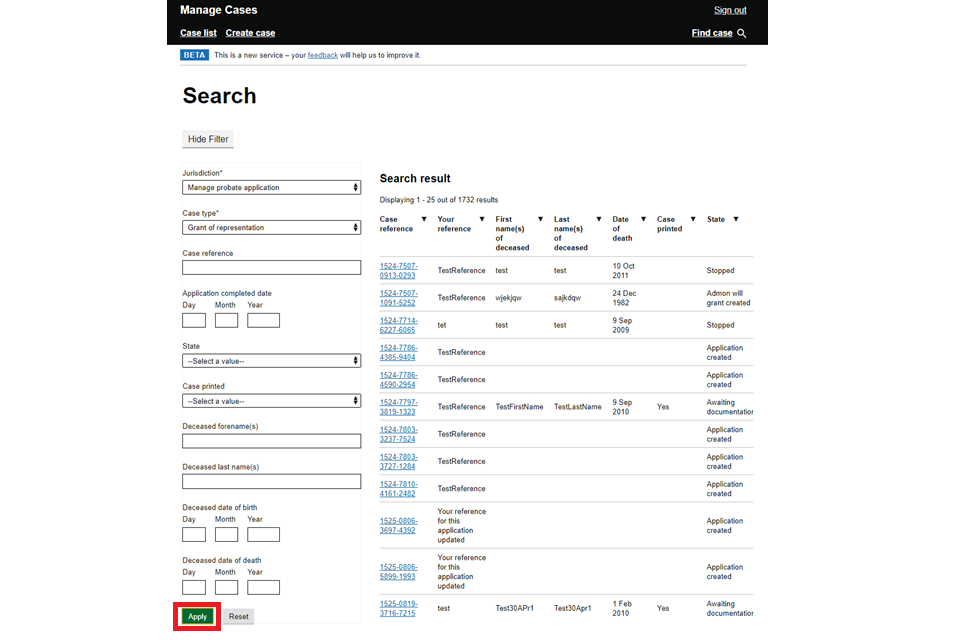

2. Using ‘Find case’ allows you to search using different criteria including the case ‘state’. Make sure you select ‘Any’ state to see all viewable cases.

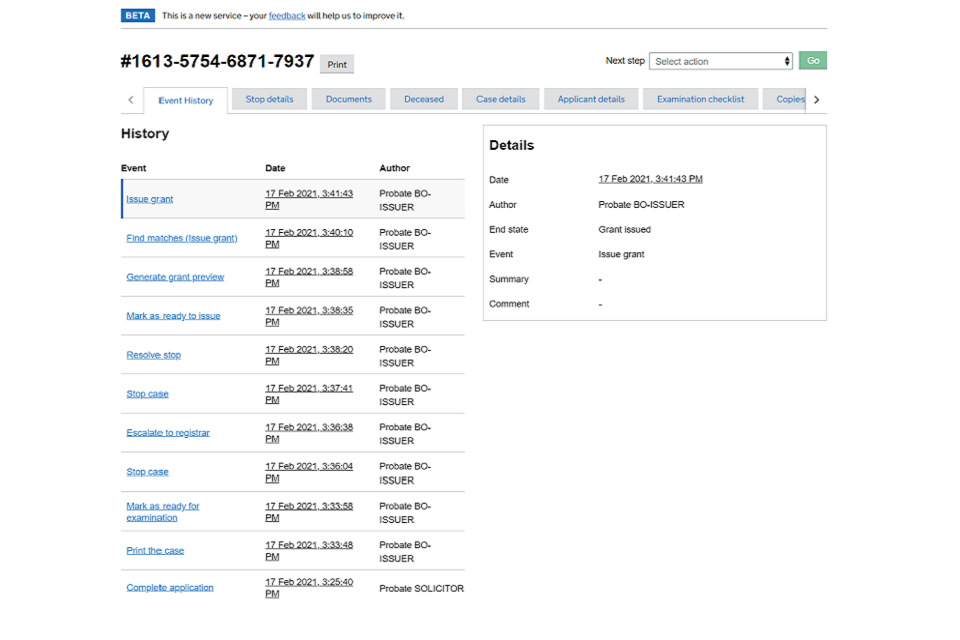

The case will open on the ‘Case Progress’ page. You can also view the ‘Event history’ to see details on when the steps were completed and the name of the case worker allocated to the case.

You will not be able to email or call the case worker direct but it may be useful to mention their name if you contact us.

You will also see your case status. Your case will not appear once it has been selected for examining. This does not mean your case is not active.

The definitions of these statuses are:

- Application created – Application is started by the legal professional but not yet submitted.

- Application updated – Application is updated by the legal professional but not yet submitted.

- Grant of probate created – Grant of probate is selected by the legal professional but the application not yet submitted.

- Intestacy grant created – Letters of administration is selected by the legal professional but the application not yet submitted.

- Admon will grant created – Letters of administration with will annexed is selected by the legal professional but the application not yet submitted.

- Case created – Application has been submitted by the legal professional and can be viewed by case workers.

- Stopped – Case worker has found an error with the application and will contact legal professional.

- Awaiting documentation – Case worker is waiting to receive mailed documentation.

- Ready for examination – Application has all documentation and is ready to be assessed.

- Examining – Application is being assessed by the case worker.

- Case stopped – Case worker has found an error with the application and will contact applicant.

- Caveat permanent – Registrar or district judge has confirmed a stop to the application as applied through a caveat.

- Registrar escalation – Case worker has escalated to registrar for advice or order.

- Ready to issue – Case worker satisfied that all information is provided and correct.

- Case selected for QA – Case has been selected for quality assurance

- Case matching (Issue grant) – Caseworker checking if application details match any other cases in the system.

- Case matching (Examining) – Caseworker checking if application details match any other cases in the system.

- Grant issued – Application passed all checks, grant issued and to be despatched within 48 hours.

- Case closed – Application has been withdrawn and closed on system.

- Case imported – Case was submitted before March 2019.

- Examining (reissue) – Case worker looking at the application, which has been returned due to an error.

- Case matching (Reissue grant) – Caseworker checking if application details match any other cases in the system.

- Case stopped (reissue) – Case worker has found an error with the application and will contact applicant.

- Awaiting redeclaration – Case worker waiting for a response to a stop letter.

- Redeclaration notifications sent – Email sent to applicant to confirm new statement of truth will be sent.

- SOT generated – New statement of truth is created and sent to applicant.

- Case printed (State/case printed) – Caseworker printed application. Accompanying documents may be yet to arrive.

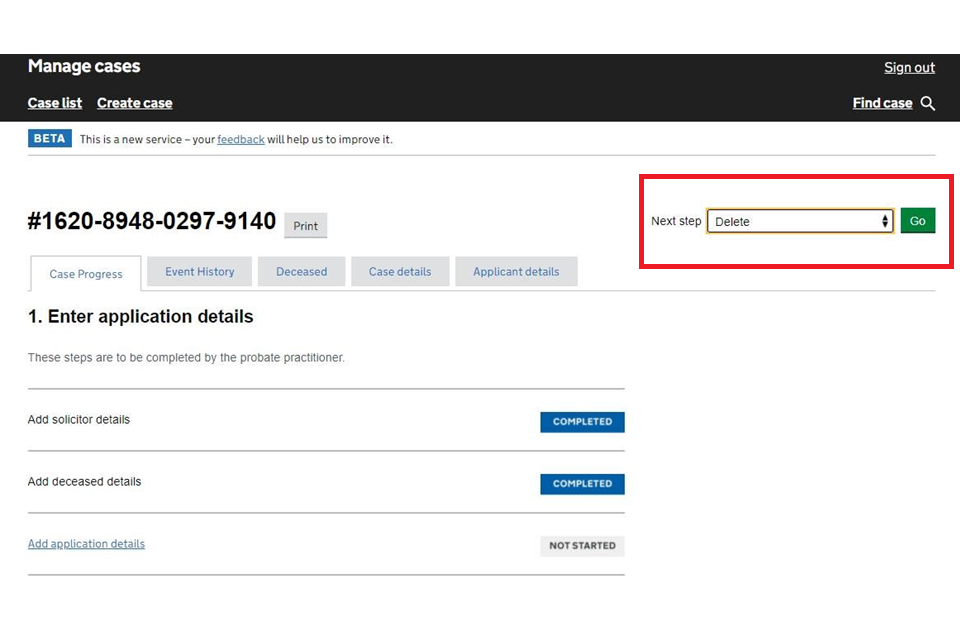

8. Delete unsubmitted applications

You can delete all application types – grant of probate, letters of administration, letters of administration with will annexed or a caveat application.

As long as the case is unsubmitted, you can delete it at any event stage. This includes where the case has been stopped because the application cannot be made online.

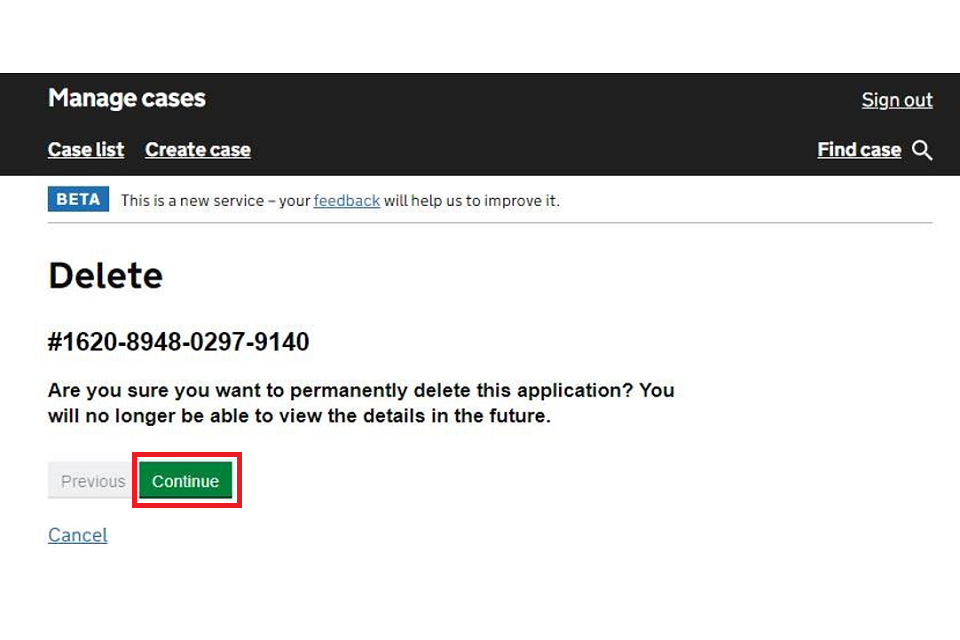

1. When in any tab of the case dashboard, select ‘Delete’ from the ‘Next step’ dropdown box and then ‘Go’.

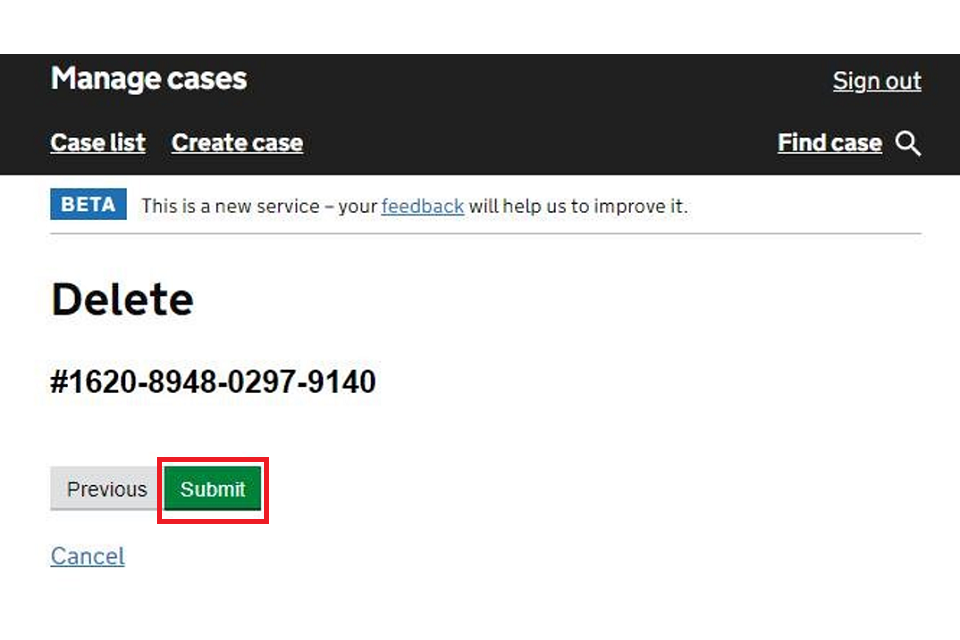

2. You will then be asked to confirm that you’re sure you wish to delete the case. Deleting a case will mean you are unable to access this again. Select ‘Continue’ to confirm. Then select ‘Submit’.

3. You will then be taken back to your case list.

Credit: Source link