Kindly sponsored by Aberdeen Standard Investments

Bouncebackability

Over the course of 2021, the property sector certainly rebounded from the depths of the pandemic-induced slumps of 2020, with the average share price of listed property companies up 14.2%. That didn’t mean there were not some ups and downs along the way. The year started with a pretty stringent lockdown in place, hampering the ability of businesses in the retail, leisure and hospitality sectors to pay rent and thus negatively impacting the value of property and dividends. However, in the background was the monumental vaccine rollout effort that saw the UK economy bounce back quickly, and soon values were back on the up and companies were looking forward with more positivity.

The Omicron variant did threaten to throw a spanner in the works at the end of the year, but as we sit here today there is cautious optimism that the pandemic is coming to an end. Inflation has moved to the top of the agenda, with the UK recording the highest levels in 30 years in December 2021. High inflation is likely to persist for much of the first half of this year, when price indices are compared to periods last year that were in full lockdown. Property companies with inflation-linked leases should be protected to some degree.

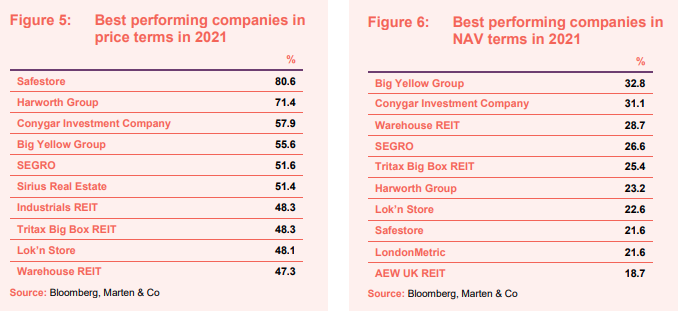

It was another year of record performance for the industrial and logistics sector, which was reflected in the share price and net asset value (NAV) of companies focused on this sector. However, the self-storage specialists were the real winners of 2021, with 70% share price rises and 20%-plus NAV growth. QuotedData’s annual real estate review rounds-up the events of 2021 and looks at the prospects for 2022.

In this review

- Performance data – Logistics and self-storage specialists dominated the top performers

- Corporate activity – Around £3.8bn was raised during the year including the launch of a new REIT

- Major news stories – Merger and acquisition activity was rife during the year, with no fewer than six buyouts

The property sector in 2021

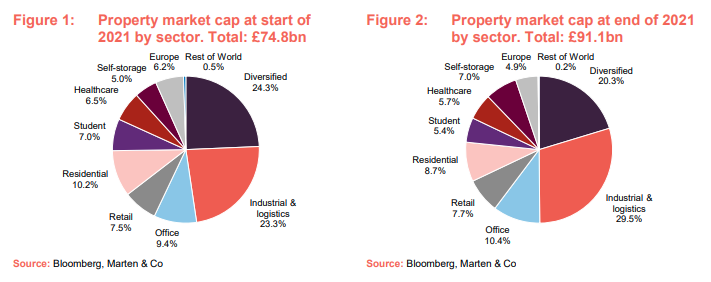

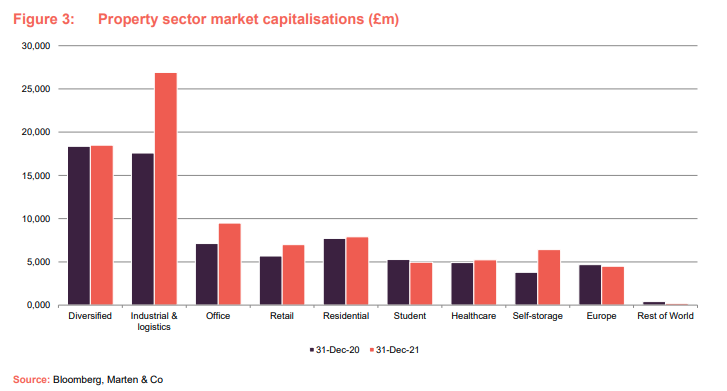

The bounce back in economic activity during the year was reflected in the total market capitalisation of listed property companies and real estate investment trusts (REITs). Overall, the sector grew by almost 22%, or £16.3bn, to £91.1bn.

A breakdown of the property sub-sectors, illustrated in Figures 1 and 2, show that companies focused on the industrial & logistics sector have continues to grow in popularity, benefited from the much-publicised increase in online retailing.

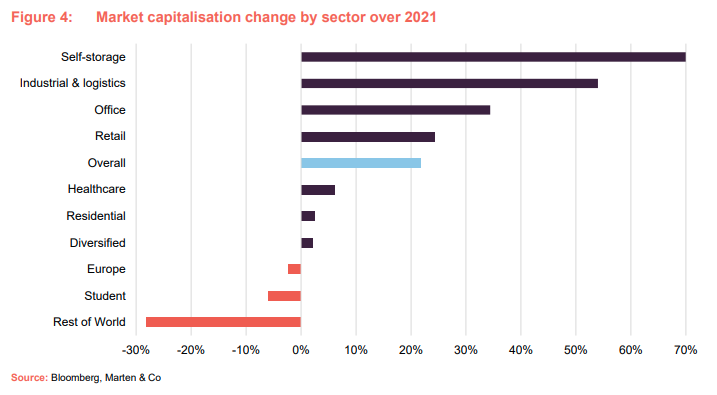

The biggest gains were found in the self-storage sector, however, where the market cap of the three leading companies increased at an average of 70% in the year. Figure 4 also shows that the market cap of the seven companies focused on the industrial & logistics sector increased by 54%. There were just three sub-sectors that experienced a market capitalisation fall during the year – Europe, student accommodation and rest of the world. The student sector shrank when GCP Student Living was acquired at the back end of the year in a take-private deal (more details on page 10).

Having been in decline for a number of years, the retail sector saw a 24% increase in its market capitalisation in the year as positivity over the effectiveness of the vaccine rollout and a return to more ‘normal’ spending resumed. Generalist (diversified) property companies, which own property in various sectors, had a mixed year, with market capitalisations increasing by just 2%.

Fund performance data

Best performing property companies

All three of the listed specialist self-storage operators had impressive years of growth, both in respect of the share price and NAV, as the sector continues to benefit from demand-side pressures. Safestore led the way with a remarkable 80.6% share price rise in the year. Big Yellow Group and Lok’n Store also had a strong 2021, with share price gains of 55.6% and 48.1% respectively.

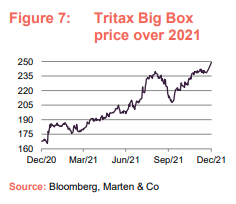

As mentioned earlier, logistics was another sector to perform well during the year and it was no surprise to see dedicated logistics players SEGRO and Tritax Big Box REIT in the top 10 best performing property companies for both share price and NAV.

Development and regeneration specialist Harworth was another constituent of both lists, seeing its share price rocket 71.4% and its NAV climb 23.2% largely thanks to an increase in the value of its industrial and logistics developments. The group also set out plans to double the size of the business over the next five to seven years.

German business parks owner and operator Sirius Real Estate saw its share price rise more than 50% in the year, during which it made several acquisitions and reported a big uplift in its portfolio valuation and NAV.

Worst performing companies

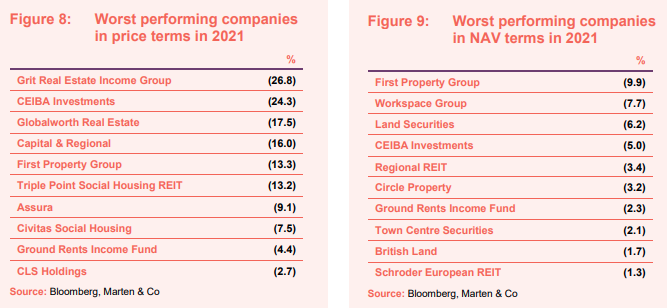

African-focused company Grit Real Estate had a tough year navigating the pandemic, with its retail and hospitality exposure weighing on its performance. The group had a busy and potentially transformational end to the year, however, raising €156.7m in an open offer and placing. It hopes to be able to provide investors with greater returns with the acquisition of a controlling stake in a development company. Part of the proceeds will also be used to lower its loan to value (LTV) ratio.

Cuban real estate investor CEIBA Investments ended a tough 2021 with a share price fall of 24.3%. The impact of the pandemic on the Cuban tourist sector has affected the value of CEIBA’s hotel assets, while a mooted lessening of US sanctions on the country has yet to materialise.

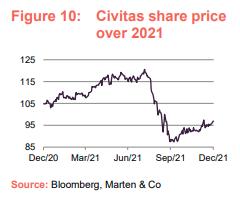

Civitas Social Housing’s share price took a dive in a three-month period from August, after coming under attack from short-seller ShadowFall. A report criticising the company for not disclosing possible conflict of interest matters in a small number of property transactions as well as questioning the strength of some of its housing association tenants was published, to which Civitas offered a detailed rebuttal. The share price picked up towards the end of the year, somewhat limiting the damage. Fellow social housing specialist Triple Point seems to have found itself in the crossfire of the short-selling drama.

Ground Rents Income Fund continued to be dogged by the regulatory uncertainty that persists in the ground rents market. It also cut its losses on its Beetham Tower, Manchester investment.

Significant rating changes

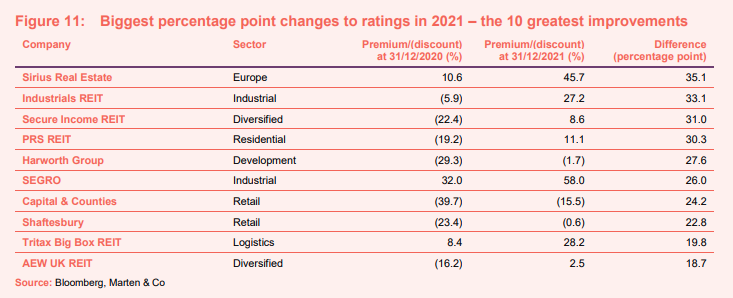

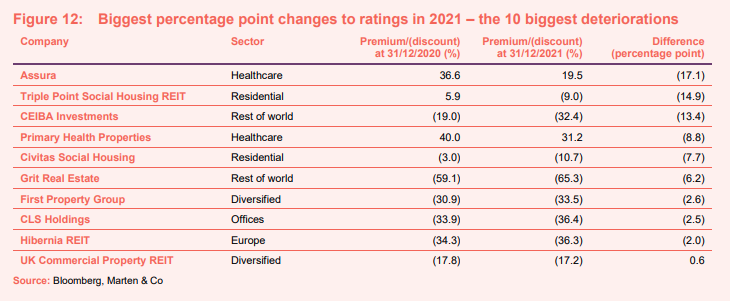

Figures 11 and 12 show how premiums and discounts have moved over the course of the year.

Several of the companies with positive rating changes were discussed in the previous section. Industrials REIT, which changed its name during the year from Stenprop to reflect its focus on the multi-let industrial sub-sector, saw a huge swing in its rating, going from a small discount to NAV at the start of the year to a large premium. The group has made strong progress in selling its non-core assets and ploughing the proceeds into multi-let industrial estates.

Secure Income REIT’s share price rose more than 40% in the year, as the reopening of the economy benefited its long-income portfolio, resulting in a its discount narrowing throughout the year and ending on an 8.6% premium.

Covent Garden landlord Capital & Counties saw its discount narrow to 15.5% in the year, with investors perhaps taking a long-term view of the strength of London. That appears to also be the case for Shaftesbury, which owns a large portfolio of shops, restaurants and offices in the West End of London, with its discount narrowing to 0.6%.

Generalist property fund AEW UK REIT had an eventful year, successfully suing two of its international tenants that had refused to pay its rent despite having the resourced. The group was rewarded for large NAV rises during the year and sticking to its sector leading dividend throughout the pandemic.

Again, many of the names in the biggest rating deteriorations table have been mentioned previously. Healthcare asset owners Assura and Primary Health Properties both saw their share prices cool during the year and their large premiums narrow. Both are still, however, trading on large premiums.

Major corporate activity

Fundraises

Just under £3.8bn was raised by property companies in 2021, as investors flocked to specialist players with the re-opening of the economy bringing confidence to markets. This eclipses the £3bn that was raised in 2020.

Life Science REIT launched in November, successfully raising gross proceeds of £350m from its initial public offering, which it will invest in life science property such as laboratories in the so-called golden triangle of London-Oxford-Cambridge.

The most active fund was Tritax EuroBox, which raised €480m (£412m) in two oversubscribed issues during the year. Also growing fast was Urban Logistics REIT, which raised £359m in two issues, and Supermarket Income REIT, which raised £353m again in two significantly oversubscribed issues.

Home REIT pulled off the biggest single raise of the year, achieving £350m in September. This was closely followed by Tritax Big Box REIT, which raised £300m also in September.

Meanwhile, Grit Real Estate Income Group, the pan-African property investor, raised $156.7m in December through an open offer and placing. Part of the proceeds, $80.6m, was made through the issue of new ordinary shares to the shareholders of development company Gateway Real Estate Africa Limited (GREA) and its asset manager Africa Property Development Management Limited (APDM) as consideration for the sale of their stakes in GREA and APDM to Grit. The remainder, $76.1m, will be used to pay off debt and reduce the group’s LTV, which had reached 53.1% at 30 June 2021, to a much more sustainable level.

Other notable fund raises during the year included:

Mergers and acquisitions

Land Securities completed the purchase of U and I Group for around £190m. Under the terms of the acquisition, U and I shareholders received 149p per share, which was a 73% premium to its prevailing closing price of 86.0p.

Yew Grove REIT shareholders approved its €177.4m takeover by Slate Office Ireland. The deal still needs court approval but it is expected that the last trading day in the company’s shares will be 7 February 2022.

Drum Income Plus REIT’s shareholders overwhelmingly approved the absorption of the trust into Custodian REIT. Drum’s shares were delisted and the new Custodian shares issued as a result of the deal started trading in November.

GCP Student Living was taken over by a consortium including Scape Living (funded by APG – a pre-existing shareholder) and iQ (funded by Blackstone) valuing the company at £969m. The bid price was a 30.7% premium to its 1 July share price and a 19.1% premium to its 31 March 2021 EPRA net tangible asset value.

St Modwen Properties was taken private by private equity giant Blackstone, which acquired the company for £1.272bn. The price represented a 21.1% premium to its EPRA net tangible asset (NTA) value.

Shareholders of RDI REIT approved the £467.9m cash offer for the company from its largest shareholder Starwood Capital. Starwood made a cash offer for the 70% of shares it doesn’t own at 121.35p, representing a discount of 19.9% to the group’s most recent EPRA NAV but a 38.2% premium to its six-month average share price.

Other major corporate activity

Two proposed initial public offerings (IPOs) failed to get away during the year. Firstly, UK Residential REIT failed to raise its target £150m after announcing its intention to float at the beginning of June. Meanwhile, the proposed £250m float of a new social housing company, Responsible Housing REIT, was postponed following the ShadowFall attack on Civitas.

After its successful fundraises, Tritax EuroBox became a constituent of the FTSE 250 index in October. The group also issued its debut bond earlier in the year – a €500m green bond – and signed an agreement with institutional investors for a new private placement of €200m senior unsecured notes in December.

Sirius Real Estate raised €400m through the placing of corporate bonds, having attained an investment grade credit rating from Fitch Ratings of BBB in May, while SEGRO launched a €500m senior unsecured green bond issue in September.

Meanwhile, Stenprop changed its name to Industrials REIT, with a new ticker of MLI. Multi-let industrial (MLI) assets now comprise 92% of its total portfolio, and the group is on course to be a 100% MLI business by March 2022.

Major news stories of 2021

- Civitas Social Housing was targeted by short-seller ShadowFall, which criticised the company for conflict-of-interest issues in a small number of transactions. Civitas’s board said the criticism was based on “factual inaccuracies”.

- Standard Life Investments Property Income Trust acquired 1,447 hectares of upland rough grazing and open moorland in the Cairngorm national park for £7.5m, where around 1.5 million trees will be planted to offset carbon emissions from its portfolio, in a first for the property sector.

- NewRiver REIT sold its pub business, Hawthorn Leisure REIT, to Admiral Taverns for £222.3m. It used the proceeds to strengthen its balance sheet and reduce its loan to value (LTV) to below 40%.

- AEW UK REIT won a High Court legal battle against two of its “well-funded” national tenants – Sports Direct and Mecca Bingo – to recover £1.2m of rent that they had refused to pay during the pandemic.

- Tritax EuroBox made €620m worth of new investments during the year, the largest of which was the acquisition of two assets in Germany, let to Puma and Wayfair, for €290.9m.

- Hammerson continued its non-core asset sell off with total proceeds during the year totalling £495m, the largest of which was the sale of its UK retail parks portfolio for £330m and its 50% stake in Silverburn shopping centre in Glasgow for £70m.

- Land Securities acquired a 75% stake in MediaCity, the 37-acre media, digital and tech hub home to the BBC in Salford, Greater Manchester, for £425.6m.

- Abrdn European Logistics Income acquired a portfolio of ‘last mile’ urban logistics assets in Madrid for €227m, fully deploying the proceeds of its September equity raise. The portfolio comprises seven newly constructed logistics warehouses and one under construction logistics warehouse. It is let to five tenants, including Amazon.

- Life Science REIT deployed £177.65m of proceeds from its £350m IPO in across four deals. The largest of which was the £77m acquisition of Rolling Stock Yard, a nine-storey office and laboratory building near London’s St Pancras station.

- British Land announced plans to move into logistics development. A 1m sq ft urban logistics scheme is planned at two of its retail sites. It is the first foray into the burgeoning logistics sector for the REIT, which has traditionally had a portfolio focused on offices and retail.

Selected QuotedData views

Outlook for 2022

Here are a few recent comments from managers and directors on how events may unfold in 2022, drawn from our latest real estate roundup.

William Hill, chairman of Ediston Property Investment Company:

“There are compelling investment reasons for the retail warehouse sector to recover further and provide ongoing value opportunities. It has proved to have been the most resilient retail sub-sector during the COVID-19 pandemic, with favourable rent collection figures and an active tenant market. Following the sell down across all retail markets, the investment manager considers the retail warehouse sub-sector to have been oversold, and there is now increasing recognition in the market that is the case. Yields look attractive when compared to other property sub-sectors, often with income secured on high quality tenants. The anticipated recovery in consumer spending will likely favour many of the retailers that trade from retail warehouses. The format also works well alongside on-line retailing, supporting retailers’ omnichannel strategies.”

Robert Orr, chairman of Tritax EuroBox:

“The [European logistics] occupational market is increasingly favourable and we expect the trends of strong occupier demand, driven by e-commerce and the reinforcement of fragile supply chains, to continue in the long term. When considered alongside limited new supply of logistics space, we expect consistent, sustained rental growth in prime logistics markets.”

Sir Julian Berney, chairman of Schroder European REIT:

“Confidence within the Eurozone has improved and expectations are for economies to move back to their pre-COVID GDP levels during 2022. Near term, markets are dealing with increasing energy costs and supply constraints, particularly regarding materials and labour, which are collectively heightening inflationary concerns. As a result, there is a risk that the European Central Bank will move to control inflation via an increase in interest rates, albeit we see this risk as modest.”

Recent real estate research notes

Urban Logistics REIT – In the sweet spot

Grit Real Estate Income Group – Showing some grit

Civitas Social Housing – Short shrift to short seller

Standard Life Investments Property Income Trust – Post-COVID ready

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.

220121 Real estate annual 2021

Credit: Source link