This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Good evening

As international sanctions against Russia intensify, their repercussions are beginning to be felt not only by the oligarchs and companies in western crosshairs, but also by western businesses and financial markets.

Life has changed almost overnight for those hit directly. Former academic, politician and businessman Petr Aven says he no longer knows whether he can pay even the most basic of bills after his business was destroyed by UK action over his alleged links to the Kremlin. “Will l be allowed to have a cleaner, or a driver? . . . We don’t understand how to survive,” he says, interviewed by the FT in his penthouse in St James.

Russian individuals and businesses are not the only ones caught in the maelstrom. We report today for example on how western banks are being tangled up in legal cases over Russian corporate bond payments. Lawyers and compliance departments have to assess whether payments to investors risk breaking sanctions while at the same time assessing the likelihood of being sued by clients for forcing them into defaults.

International companies still operating in Russia or trying to extricate themselves also face complications. It is not clear for example whether companies such as Credit Suisse, Morgan Stanley and British American Tobacco that have Moscow offices linked to the empire of sanctioned oligarch Roman Abramovich are breaching sanctions by paying their rent.

There are also significant costs for those pulling out completely. Carlsberg said today it would take a “substantial” hit to its business by exiting Russia, just hours after rival Heineken announced it would be leaving. Carlsberg has a larger business in Russia than any other western brewer, accounting for 9 per cent of its revenue and 5 per cent of its profits.

Sanctions could also indirectly affect the way companies are run, writes management editor Andrew Hill, pointing to the way companies accelerated moves to new ways of working during the pandemic.

Successful businesses are those that can turn an external shock to their advantage, he argues, such as using energy rationing to secure supplies and improve efficiency. “Learning from their own and others’ experience in a crisis has been shown to improve managers’ response to the next disaster,” he writes.

Latest news

Bank of England governor Andrew Bailey warns of ‘historic shock’ to incomes (Evening Standard)

ECB agrees €10bn swap line with Poland amid war in Ukraine

German chancellor Olaf Scholz says there are more sanctions against Russia ‘in the back pocket’ (Reuters)

For up-to-the-minute news updates, visit our live blog

Need to know: the economy

Shanghai was today split in two, with connections blocked to the rest of China as authorities tried to contain a serious outbreak of coronavirus infections in the country’s leading financial centre. The Lex column said the move would mean a significant hit to China’s economic growth and create more uncertainty for global supply chains.

G7 energy ministers rejected Vladimir Putin’s demand that Russian oil and gas should be paid for in roubles, marking an escalation in a stand-off that could have broad consequences for commodities markets.

Latest for the UK and Europe

UK prime minister Boris Johnson’s promised energy security strategy has been delayed again as chancellor Rishi Sunak holds out against big new spending commitments. Heavy industry also faces tens of millions of pounds in extra costs if an important support scheme for energy-intensive sectors is not renewed before the end of March.

Columnist Martin Sandbu says last Friday’s EU leaders’ announcement that they would explore joint energy procurement is a momentous move. “The 1970s shocks came from the young Opec flexing its muscles. The 2020s shocks should give birth to a European anti-Opec,” he writes. The Lex column says steps to reduce gas use could avoid Europe suffering shortages. France is the latest country to urge businesses and consumers to save energy.

The EU’s plans to cut reliance on Russian gas depends on its ability to secure specialised ships and rapidly build associated infrastructure, a point underlined by the Lex column. The floating storage and regasification units (FSRUs) are liquefied natural gas tankers that use seawater to turn the fuel back into gas.

Global latest

WTO chief Ngozi Okonjo-Iweala told the FT that export controls risked worsening food supply problems and that countries with surplus stocks of products such as vegetable oils and grains should release them on world markets. A surge in prices of fertiliser is also fuelling fears of a food crisis, a problem exacerbated by a lack of competition in the US fertiliser industry.

US president Joe Biden has flagged proposals for a minimum tax on investment income of the wealthiest Americans. The White House said the country’s richest paid just 8 per cent of their total realised and unrealised income in taxes, while a firefighter or teacher paid double that rate. Rising petrol prices, fading fears of coronavirus and the return to the office mean Americans are starting to return to public transport.

A “less-discussed reality” of the war in Ukraine is the big and growing risk for the economies of the west, writes chief foreign affairs commentator Gideon Rachman. The shock will be most acute in Europe in the form of rising prices, energy shortages and the challenge of absorbing up to 10mn refugees, but the US too will feel the pain in the form of soaring petrol prices, he says.

Shorter-dated US government bonds were hit with a fresh bout of selling as investors readied for a more aggressive tightening of monetary policy from the Federal Reserve, though the FT editorial board cautioned that recent moves in bond markets did not necessarily point to recession. There are rising expectations that the Fed will make “jumbo” or half-point rate rises to try to contain inflation.

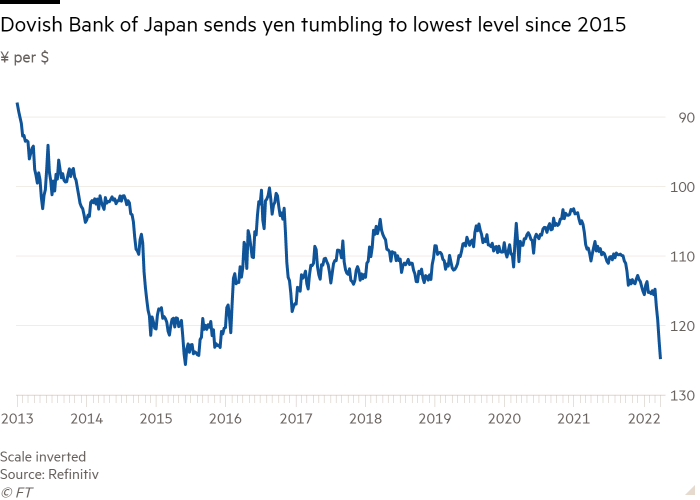

The Bank of Japan, however, bucked the trend towards tightening by reaffirming its commitment to economic stimulus and its attempts to keep bond yields low even as the Fed and others ratcheted up rates. The yen fell to new lows against the dollar in response.

Need to know: business

Staff at HSBC have objected to the bank’s removal of references to the Ukraine “war” in analysts’ reports in favour of terms such as “conflict”. HSBC has said it would not take on new business in Russia but has stopped short of following banks such as Goldman Sachs and JPMorgan to the exit.

In our Asset Management newsletter, Harriet Agnew looks at how investors are adjusting to the increasing demand for onshoring production as the war in Ukraine wrecks global supply chains already dented by the pandemic. Sign up here to get the newsletter sent straight to your inbox every Monday.

US companies are busily repurchasing shares to take advantage of stock market volatility and reassure investors as growth slows. Share buybacks prop up demand for stock and increase earnings per share by reducing the number of shares in circulation.

The pandemic-fuelled acceleration in digital transactions, followed by new cyber risks from Russia, is forcing companies to improve their systems. Business also need to adapt to new regulations on storing personal information. Read more in our Special Report: Navigating Cyber Risk.

The new season of our Tech Tonic podcast features Global China Editor James Kynge on China’s dramatic transformation from the manufacturing workshop of the world to the next global superpower, and discusses the country’s tussle with the US for tech supremacy.

The World of Work

The pandemic has led many of us to re-evaluate our lives and our relationship with the workplace, writes leadership consultant Gabriella Braun. This means managers need to be more aware of what their returning staff expect in terms of professional and personal support but without turning into therapists. “If the increased emotional awareness of the past two years is built on, re-entry will be an opportunity to improve workplaces and working practices,” she writes.

Remote towns and villages are taking advantage of post-pandemic working patterns to attract professionals. Portugal is offering grants to persuade workers to relocate to the countryside, following similar schemes in Italy, Ireland, Switzerland, Spain, Greece, Croatia and the US.

Covid cases and vaccinations

Total global cases: 473.2mn

Total doses given: 11.2bn

Get the latest worldwide picture with our vaccine tracker

And finally .

“Art can neither prevent a humanitarian catastrophe nor shield civilians from the continuous shelling by Russian planes and rockets. It is, however, capable of making the crimes of the war visible, speaking loudly about them to the global community and raising the public’s spirit in the gloomiest moments.” Art historian Svitlana Biedarieva examines how artists in Ukraine are expressing steely determination and the survival of the spirit.

Recommended newsletters

Free Lunch — Start every week with a preview of what’s on the agenda. Sign up here

FT Asset Management — The inside story on the movers and shakers behind a multitrillion-dollar industry. Sign up here

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

Credit: Source link