Presented to the House of Commons pursuant to Section 7 of the Government Resources and Accounts Act 2000.

Ordered by the House of Commons to be printed on 8th July 2021.

Any enquiries regarding this publication should be sent to:

The Planning Inspectorate,

Temple Quay House,

2 The Square,

Temple Quay,

Bristol

BS1 6PN

Tel: 0303 444 5000

The Planning Inspectorate,

Cathays Park,

Cardiff

CF10 3NQ

Tel: 0303 444 5940

Email: General Enquiries: enquiries@planninginspectorate.gov.uk

Press Enquiries: press.office@planninginspectorate.gov.uk

Welsh Enquiries: wales@planninginspectorate.gov.uk

This publication is available in:

Welsh – contact the Inspectorate’s Cardiff office. Large Print – contact the Inspectorate’s Bristol Office.

Mae’r cyhoeddiad hwn hefyd ar gael yn Saesneg trwy gysyltu â Swyddfa’r Arolygiaeth yng Nghaerdydd, ac mewn print bras trwy gysyltu â Swyddfa’r Arolygiaeth ym Mryste.

Introduction

As the Planning Inspectorate we are fair when it comes to listening to differing views, open in the way we work, impartial in our examinations, deciding appeals and handling applications and focused on delivering for our customers.

Across England and Wales, our Inspectors deliver decisions and recommendations across our three public services: examinations, appeals and applications.

To do this, we make sure development is carefully considered, that the right homes are constructed in the right places, and that green spaces are protected. We make sure that proposed developments meet future needs for the economy, environment and society and that the community’s views on large infrastructure applications are heard. We uphold and promote quality, assuring the checks and balances of the planning system, so that decisions are fair, impartial and open. We examine the local plans from Local Authorities that set the framework for economic, social and environmental priorities. We have specialist experts able to advise and decide cases on specialist subjects across environmental, ecological, historic and arboricultural matters. The work of our Inspectors is supported by skilled professionals delivering casework support, specialist advice, customer service, corporate services, knowledge management, project management and digital expertise.

To be customer focused

We have diverse customers with diverse needs. We know most customers want a better service, delivered in a timely manner and our information to be clear, consistent and easily accessible. Beyond this, we are using the insights from the Institute of Customer Service’s survey to improve our customer service.

Activities delivered in 2020/21

- We merged customer-facing roles into one team and created new roles to improve our customer service.

- We benchmarked our customer service through the Institute of Customer Service.

Strategic risks

- S11 Data protection

- S13 Failure to manage stakeholders

- S17 Missing opportunities to improve customers’ experience

Activities planned for 2021/22

- We will develop a customer strategy to deepen our understanding and gain insights about our customers’ needs and expectations.

- We will use those insights from customers to drive and prioritise changes and innovation.

- We will take actions on the findings from the Institute of Customer Service survey.

Performance

- The Institute of Customer Service surveyed a sample of our customers. We scored 57.6% on the benchmark scale (the public services national sector score is 76.1%) and scored 60.5% on customer service (the public services national sector score is 77%).

- These results provide us with the important insights we need to enable us to improve and meet the expectations of our customers.

Graph 1. Inspectorate’s score against the Institute of Customer Service’s benchmark 100%

Graph 2. Inspectorate’s score on customer service 100%

To effectively and efficiently serve people, places and the economy

Our work results in well-informed decisions, reports and recommendations that serve people, places and the economy. As part of the country’s recovery from the impact of the COVID-19 pandemic, we’ll play our part by focusing on delivering our work in a timely manner.

Activities delivered in 2020/21

- We adapted the way we work to keep casework moving despite the pandemic. This year we made around 17,000 recommendations and decisions in England and over 500 in Wales.

- We implemented safety measures for site visits and held over 700 virtual hearings and inquiries.

- We developed a more advanced modelling capability to improve Inspector programming, optimising our use of skills and resources.

Strategic risks

- S1 Capability and capacity

- S3 Change projects’ benefit realisation

- S4 Operational performance

- S12 Failure to embed changes

- S15 Impact of national infrastructure applications

Activities planned for 2021/22

- We will simplify the way we write and publish decisions and recommendations, to improve accessibility for our customers.

- We will use a hybrid of procedures, mixing elements from written representations, hearings and

inquiries, in order to improve the flexibility of our operations. - We will continue to develop and trial digital public services for our customers.

- We will liaise with the Ministry of Housing, Communities and Local Government to improve how our performance is measured.

- We will invest to improve our performance.

Performance in England

- We issued 32 reports following the examination of local plans and issued 10 reports in response to Nationally Significant Infrastructure Project applications.

- We made over 16,800 decisions in response to appeals.

- The pandemic impacted our capacity to make decisions for appeals. In consequence the median decision time increased from 21 weeks in 2019/20 to 23 weeks.

Performance in Wales

- We issued one report following a local development plan examination and two reports in response to Development of National Significance applications.

- We made 500 decisions in response to appeals.

- The pandemic impacted our capacity to make decisions for appeals in Wales as well. In consequence the average decision time for planning appeals increased from 13 weeks in 2019/20 to 15 weeks.

Graph 3. Appeals in England over the last five years

Graph 4. Planning appeals in Wales over the last five years

To be an attractive and inclusive organisation

As part of being a safe and attractive place to work, we want to develop our people and improve our equality, diversity and inclusivity. We must also maintain our strengths as trusted experts, that embody our organisational values (fair, open, impartial and customer-focused).

Activities delivered in 2020/21

- We kept our people safe during the pandemic, supported those with caring responsibilities and promoted the importance of health and wellbeing.

- We transitioned into a new operating model, including recruiting to over 200 posts.

- We developed an employee equality, diversity and inclusion approach, as a contribution to our Public Sector Equalities Duty and to the UN Sustainable Development Goals.

Strategic risks

- S7 Change in the organisation

- S16 Health, safety and wellbeing

Activities planned for 2021/22

- We will continuously develop our pay and reward approach to ensure equal pay for equal work.

- We will implement our equality, diversity and inclusion approach to attract a diverse pool of

applicants for new positions that better reflect the communities that we serve. - We will develop our professions to ensure we retain a skilled workforce to meet our current and future challenges.

- We will develop an environmental policy and start benchmarking our performance.

Performance

- Our 65% employee engagement score is very close to the civil service benchmark of 66%.

- Our gender pay gap in March 2021 was 13%, similar to our performance over the last five years.

Graph 5. Civil service survey engagement

Graph 6. Gender pay gap over the last five years 100%

To plan for the future

We need to become a more agile organisation, able to anticipate and respond to changes. This will enable us to sustainably deliver an effective and efficient service across all our services.

Activities delivered in 2020/21

- We worked with stakeholders to identify improvements to the application service as part of Project Speed.

- We prepared for new policies and processes resulting from the Environment Bill 2020.

- We established capabilities in strategic workforce planning, horizon scanning, innovation and continuous improvement.

- We progressed the transformation programme to improve digital public services.

- We scaled up our capacity for virtual events.

Strategic risks

- S2 Horizon scanning and resource planning

- S14 Planning for the future and Project Speed

Activities planned for 2021/22

- We will work with the Ministry of Housing, Communities and Local Government to contribute our knowledge and expertise at the design stage of Planning for the future.

- We will continue to work on Project Speed.

- Engaging with stakeholders, we will explore how we can improve our approach to future events in a post-pandemic world.

- We will continue to develop and trial digital public services for our customers.

Performance

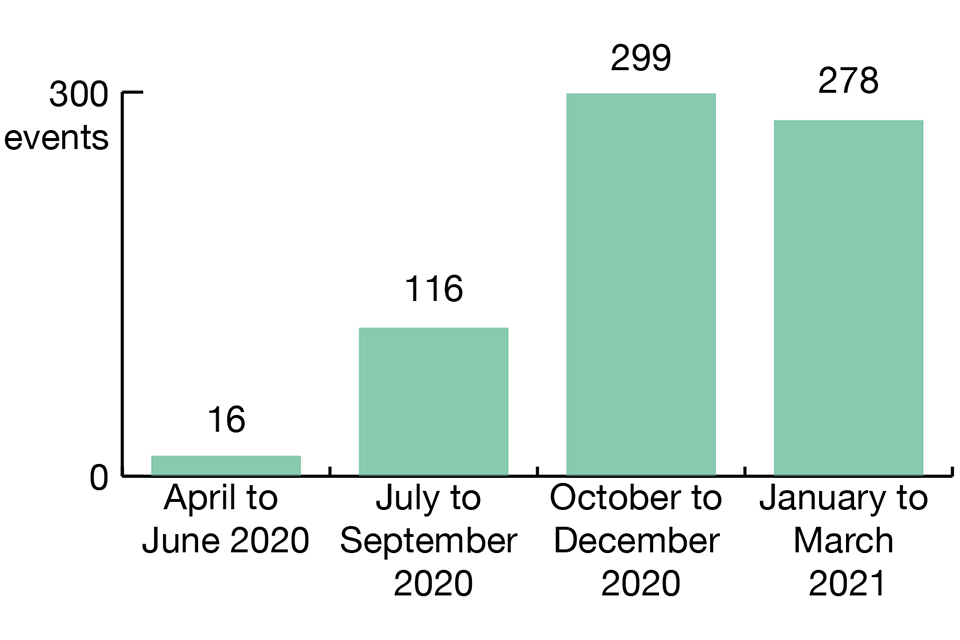

- From June to September 2020, we scaled up our capacity to host virtual events. Since October we have held on average about 90 events a month. (There are some concerns about the quality and accuracy of the data collection methods for this data on virtual events. See our statistical releases and background quality reports for more details.)

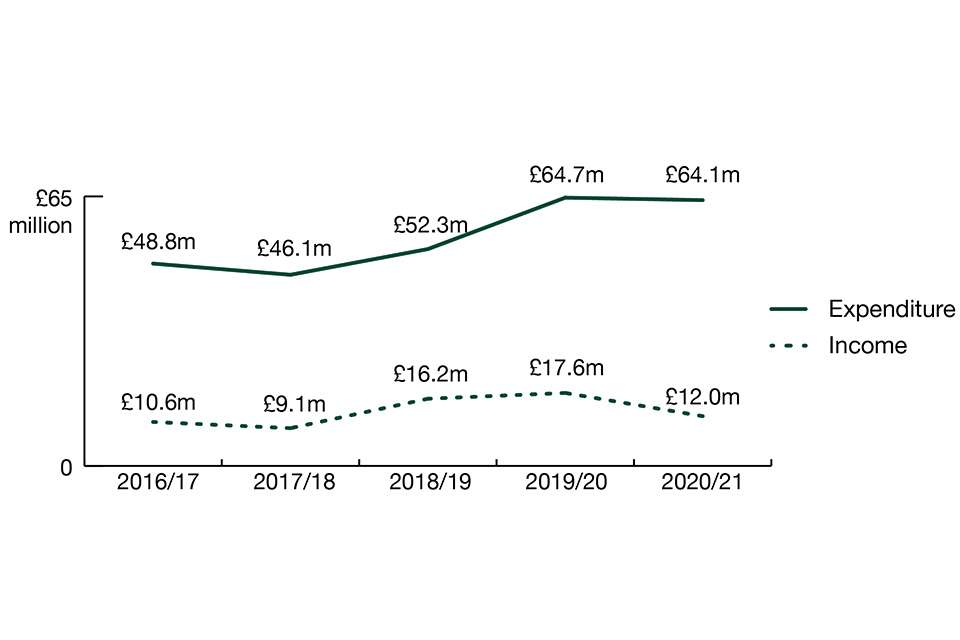

- Over the last five years our expenditure on change has increased year on year, culminating at

£7.1m in 2020/21.

Graph 7. Virtual events held in England in 2020/21

Graph 8. Change expenditure

Chief Executive’s Statement

The impact of the COVID-19 pandemic dominated our thoughts and influenced our actions throughout last year. My overarching feeling is of pride in our response to change and the achievements the Planning Inspectorate has made.

In 2019/20, we reported the successful rollout of our performance recovery programme.

We significantly improved our casework performance. We made substantial progress with implementing the recommendations of the Rosewell review, and the average time taken to decide appeal inquiries was nearly halved. We had planned to continue with this drive in 2020/21, but the COVID-19 pandemic impacted our plans.

From the start of lockdown in late March 2020, I set three clear priorities: ensuring our people’s wellbeing, keeping casework moving and supporting the Ministry of Housing, Communities and Local Government. Throughout the year, I’m pleased to say that we have continued our work in these exceptional circumstances, and I’m immensely proud of the work our people have done to keep casework moving.

The lockdowns restrictions have reduced the availability of our Inspectors due to shielding and caring responsibilities, limited our capacity to conduct site visits and hold the events needed to progress our cases. In response, we have shown resilience in implementing safe changes to our operations, which have allowed us to progress our customers’ cases as quickly as possible. The implementation of virtual events has meant that we’ve been able to hold hearings and inquiries safely. It has allowed customers and stakeholders that wouldn’t normally have had the opportunity to be involved, to attend or watch such events. This achievement was recognised by two nominations for the Royal Town Planning Institute’s Planning Excellence Awards.

This year we have also completed the second stage of our organisational redesign, with filling over 200 new positions. Developments in our data, innovation, governance, commercial, customer services, and knowledge management and horizon scanning, have resulted in better resource planning and greater resilience to future changes.

Looking forward to the next 12 months, we will have many new challenges. The results from the Institute of Customer Service survey have provided us with a road map of what we need to do to improve our services. We have a programme of activities to improve our operations. We will be focusing on equality, diversity and making the Inspectorate even more inclusive. Towards the end of 2021, we will see the completion of our transformation programme, which will improve the way we work and the interactions our customers have with us. Implementing our innovation strategy will help us get ready for the next set of changes.

In 2021/22, we’ll be preparing for a radical reform of the planning system and we have been working closely with the Ministry of Housing, Communities and Local Government. The Planning Bill, due in autumn 2021, will have a major impact on both the work we do and how we do it. We are also at the heart of a ministerial initiative called Project Speed, which focusses on speeding up the development of Nationally Significant Infrastructure Projects. The creation of an independent Inspectorate for Wales, the Welsh Planning Inspectorate, planned for October 2021, is another change we will deliver in partnership with both our governmental sponsors.

You will notice that we have made changes to the way we report, analyse and present data and information about our performance. I hope you find this improved format more accessible and easier to understand. If you have any comments or feedback, you can find our contact details earlier in this document.

Once again, I’d like to say how proud I am of our people at the Planning Inspectorate in what has been a truly challenging time.

Sarah Richards

Board Chair’s statement

The onset of the COVID-19 pandemic reshaped the world. Its impact has been monumental on a human, organisational and societal level. I commend the Inspectorate’s response: adapting at pace while maintaining its strategic focus and principles.

I am proud of the way the Inspectorate has responded to the challenges of the year, it has demonstrated its resilience and commitment to delivering its purpose. I am grateful for the collaborative way partners have worked with the Inspectorate to progress their work in new ways. I am also grateful to Ministers for their support and interest in the Inspectorate’s work.

The investment over recent years technology and training, as well as a maturing approach to risk management meant the Planning Inspectorate was well-prepared for an immediate switch to home working, drawing on the experience of home-based Inspectors. The focus the Inspectorate gave to wellbeing and support has been invaluable, borne out in the increased employee engagement score. The Planning Inspectorate has transformed itself: most visibly through the introduction of virtual events, with over 700 held by the end of March 2021. Public interest and engagement in planning showed, with over 15,000 people viewing the South Oxfordshire local plan examination for example. The level of change has been significant, much has been learned, with more to come as a result.

The impact of the pandemic slowed the progress on improving timeliness, but it has not blown the Inspectorate off course. Throughout the year, the Board received robust assurance around strategic delivery. The Inspectorate has continued to make progress against its plans by: implementing the Rosewell recommendations, improving the digital journey with Local Planning Authorities, implementing organisational redesign and welcoming six apprentices, improving approaches to equality, diversity and inclusion and to health, safety and wellbeing.

The Inspectorate was also able to support the Ministry of Housing, Communities and Local Government with its response to the pandemic and preparations for leaving the European Union. The Ministry has drawn on the knowledge and experience of Inspectors in their work on Planning for the future and on expertise on the Nationally Significant Infrastructure Projects for Project Speed. The Welsh Government is working with the Inspectorate on the creation of an independent Welsh appeal regime scheduled to go live in October 2021.

The Inspectorate’s work in normal times is critical to the wellbeing of our nations by supporting the creation of sustainable communities, enabling the delivery of homes, jobs and infrastructure, protecting the environment and focusing on what matters to local communities. This helps deliver the United Kingdom’s commitment to the United Nations Sustainable Development goals. The Inspectorate’s work will be vital as we all seek to recover from the impact of the pandemic.

On behalf of myself and fellow Non-Executive Directors, I wish to thank Sarah Richards, her executive team and the resilient and skilled colleagues across the Inspectorate for their inspirational work this year. The nominations for the Royal Town Planning Institute’s awards were certainly well-deserved.

Trudi Elliott

Our stakeholders and customers

In our Strategic Plan, we outline our ambitions to increase our customer focus, recognising the importance of gaining a deeper understanding of who our customers are and the best ways to serve them and their diverse needs.

Our customers

We have a varied group of customers across our appeals, applications, and examinations services. Our customers are made up of appellants, planning agents, Local Planning Authorities, other Government agencies, developers, landowners, parish councils and many more. We are deepening our understanding of our customers’ needs and expectations to align our services to them. This year we became a member of The Institute of Customer Service to benefit from their guidance and best practice. The Institute of Customer Service also ran a survey on our behalf to benchmark our service against other public services and organisations in other sectors. We published a blog about the results and show the highlights in the Performance Overview. This is the first step in our ambition to improve our focus on customers, as we look to shape our Customer Strategy in the months ahead.

Our stakeholders

We know the importance of good stakeholder relationships, and the benefit they can bring to the Inspectorate. In addition to our customers, our key stakeholders include: ministers and officials at the Ministry of Housing, Communities and Local Government and at the Welsh Government; Local Planning Authorities; statutory consultees; professional bodies and groups.

Keeping our stakeholders informed about our activities, successes and challenges is important to us. We have continued to engage with key stakeholders and taken part in numerous speaking engagements and webinars. We know that there is more that we can do in this space and will be building from our current stakeholder map. We are creating a communications and stakeholder strategy to support the delivery of the Strategic Plan. It will further identify our stakeholder segments and outline best practice for engagement and communication.

In our efforts to raise the profile and understanding of the Planning Inspectorate and our role in the planning system, we have created and published a new ‘flagship’ corporate film. It is a high- level summary of our roles and responsibilities and since January 2021, it has been included in our recruitment packs issued to potential candidates.

New ‘flagship’ corporate film

COVID-19 pandemic response to customers and stakeholders

From April 2020 to March 2021, the year has been dominated with managing the impact of the COVID-19 pandemic. We rapidly adapted to working differently and keeping our customers and our people informed on our website, Intranet and social media channels. In May, the Secretary of State for Housing, Communities and Local Government released a Written Ministerial Statement creating the policy expectation that all hearings and inquiries should be delivered virtually with only a few exceptions. We scaled up our efforts to conduct events online and switched from physical events to virtual ones. This was an innovative and ambitious project that allowed us to keep casework moving and widen attendance. Despite positive feedback, we recognise it is not a perfect solution for all parties, the future role for virtual events is being developed in conjunction with our stakeholders. Notably a webinar was held in December 2020, chaired by Bridget Rosewell, that sought to gather views from a cross-section of the planning community to inform our future direction.

Website Over 328k page views of Planning Inspectorate content on GOV.UK.

Twitter We gained 791 new followers; received 650k tweet impressions; and were mentioned 3k times.

Press enquiries On average we respond to 7 journalist queries per week.

LinkedIn We gained 4k new followers and received 600k impressions.

Mentions in the press On average, the Planning Inspectorate is mentioned around 120 times per week in the news.

Youtube Over 675 people subscribed to our channel and we have 128k views.

Our statutory framework

Our work is bound by a statutory framework within which we are expected to operate. Acts of Parliament and of the National Assembly for Wales, set out most key rights within the planning system.

Defining the planning system

As part of our three public services, we examine the soundness of local plans, determine a range of appeals and applications, and make recommendations on Nationally Significant Infrastructure Projects. In Wales, where planning is a devolved matter, we also make recommendations on Developments of National Significance.

The planning system within which we operate is described as plan-led and is defined by a number of Acts. Four key pieces of legislation are particularly significant for our work. These are:

- The Planning and Compulsory Purchase Act 2004, covers the local plans system, as well as the statutory duty to determine planning applications and appeals in accordance with the development plan, unless material considerations indicate otherwise.

- The Town and Country Planning Act 1990, covers the right to appeal for planning, enforcement, and lawful development certificate cases, as well as our ability to determine the procedure for a variety of case types.

- The Planning Act 2008, covers the consenting regime for Nationally Significant Infrastructure Projects in England. It also includes some limited provisions relevant to Wales, that are separate from the Developments of National Significance.

- The Planning (Wales) Act 2015 covering the Developments of National Significance regime

in Wales.

Other Acts and related legislation cover Listed Buildings and other, less common, areas of our work, such as rights of way, and environmental appeals.

Defining the rules and regulations

Secondary legislation provides the detail that supports the planning system. It defines what development may be lawfully permitted without seeking planning permission, as well as when prior approval should be sought. It sets out the form in which an appeal should be made as well as establishing our procedures for handling those appeals.

Meeting our statutory duties

The statutory framework ensures the fair operation of the planning system. But we are also bound by other statutory duties, for example, those relating to data protection as set out in the General Data Protection Regulation or the Public Sector Equality Duty. At all times, we are required to ensure that we comply with relevant legislation, but we must also ensure that parties involved in our casework meet their own obligations.

Future Wales

In Wales, the Welsh Government has published Future Wales: the national plan 2040. It provides a spatial context for facilitating the delivery of development in Wales over the next 20 years, and contributes to the broader ambitions of the Welsh Government and to the well-being of communities. We have a pivotal role to play in this.

The Well-being of Future Generations (Wales) Act 2015 seeks to place Wales on a sustainable path to improving wellbeing. The Future Generations Commissioner has reported that getting planning right can help meet wellbeing goals, and acknowledges we are starting to reinforce the requirements of the act in our approach to decision making. We must look to maximise the principles of the Act both within our organisation and through our decision making.

Changing legislation now, and in the future

We must ensure we respond to any changes in legislation that affect our work. These will not only regulate parts of our work but may also open up avenues for new types of casework, or provide us with greater flexibility to manage our casework in the interests of our customers.

In England, in response to the pandemic, changes to the Town and Country Planning Act 1990 allowed for the life of expiring planning permissions to be extended, resulting in new work. Other changes now allow us to use a combination of procedures to determine appeals casework, creating greater flexibility and efficiency for the benefit of our customers (see Our operations).

Future changes may be more wide-ranging in England. The planning White Paper Planning for the future proposes a number of radical reforms to the current plan-led system, setting out to streamline and modernise the planning process. It will require us to respond and adapt, changing both the nature of our work and the way we conduct that work. Project Speed is another government-led initiative that aims to improve the process for Nationally Significant Infrastructure Projects. It will challenge stakeholders to remove barriers and work faster together within the current framework of the Planning Act 2008.

Whatever the scope of the changes that come forward, we will continue to ensure we operate within the statutory framework in the interests of all those involved in the planning system.

Our strategy

Our purpose is to work together to deliver decisions, recommendations and advice to customers in an open, fair, impartial and timely manner. Our strategy maps the way we deliver our purpose, live our values and realise our vision.

In anticipation of the changes laid out in the Planning for the future White Paper, we did a light touch refresh of our Strategic Plan in 2020. We published this in January 2021 following approval from the Ministry of Housing, Communities and Local Government and the Welsh Government.

We built the revised Strategic Plan with the customer at its heart, with most changes relating to objectives. We kept our vision and the essence of our strategic priorities, which are:

To be customer-focused

We continue to seek opportunities to shape our systems and processes to deliver improved services that meet our customers’ and stakeholders’ expectations.

To effectively and efficiently serve people, places and the economy

Our work plays a critical part in both the Ministry of Housing, Communities and Local Government achieving its objective of delivering the homes the country needs, and in the Welsh Government delivering the principles of the Wellbeing of Future Generations Act.

To be an attractive and inclusive organisation

We plan to develop an inclusive, skilled, and engaged workforce, representative of our customers and reducing any existing inequalities. We also adhere to the principles of sustainable development and aim to evaluate our impact on communities and the environment.

To plan for the future

Building a culture of innovation and continuous improvement is key to our readiness for the future. This will include us partnering and supporting others to improve the planning system at a local and national level.

We identified 15 strategic objectives for 2020/24 that will realise our priorities and created a framework to enable us to monitor our progress and performance. The business plans for 2020/21 and 2021/22 support the delivery of these objectives. Our strategic objectives and business plans align with the priorities set for us by the Ministry of Housing, Communities and Local Government as our sponsoring department.

We are required to have a three-year rolling Strategic Plan. In 2021/22 we will reshape our Strategic Plan in response to our changing customer expectations, operating environment and legislative changes.

Purpose: To work together to deliver decisions, recommendations and advice to customers in an open, fair, impartial and timely manner.

Values: Customer-focused; Open; Impartial; Fair.

Vision: To provide a customer-focused, professional and innovative centre of excellence with trusted, independent planning experts, meeting the Government’s objectives at a local and national level whilst working with others to improve the planning system.

Our 15 objectives

Improve how we engage with our customers.

Provide clear, accurate, easily accessible, transparent and robust information, to enable a modern, efficient and continuously improving planning process.

Continue to strongly uphold our reputation for values of fairness, openness and impartiality, and the quality of our decision making.

Improve our casework performance and meet the changing demands of the planning system.

Deliver improved assurance on the efficiency, quality, fairness, openness and impartiality of our decisions.

Work alongside the Ministry to deliver legislative change, improving the planning system and the end-to-end experience for customers.

Analyse and share best practice with Local Planning Authorities, to improve the customer experience of the overall planning system.

Develop our culture of inclusivity to attract, engage and retain a diverse workforce that increasingly represents the communities we serve, ensuring we have the skills for the future.

Undertake work to identify our community and environmental impact and the impact of the COVID-19 pandemic. This allows us to adjust our working practices, contributing to the achievement of sustainable development goals.

Effectively manage performance and talent to continuously develop our organisational capabilities. This will ensure flexible and customer-focused delivery of service and readiness for the future.

Empower our people to raise issues and consider risks.

Develop and implement a digital strategy that will maximise the benefits of digital technology to meet evolving customer expectations and to provide greater value to the taxpayer.

Encourage and value creativity, new ideas and acceptable risk-taking in the development of new services and improvement of current ones.

Use our data to enable the planning sector to operate more efficiently.

Increase our ability to see what is coming so we can prepare for changes.

Our risk profile

As the world challenges us and as we change and evolve, we use risk management to systematically mitigate the threats that could keep us from realising our strategy.

Strategic risk management

Our risk management process identifies, assesses, addresses, records and mitigates uncertainties to the delivery of our strategic priorities, objectives and activities. The strategic risks are the most important threats to delivering our strategic priorities, we focus on those here. Each risk is assessed using a five-by-five scoring matrix. We rate the impact by considering the consequences of a risk on our ambitions, people, customers and stakeholders. We rate the likelihood by considering the probability of a risk to materialise.

Our risk appetites express the amount of risk we are willing to take on, by type of risk. Appetites vary according to the activity: for example, we are willing to take on uncertainty when innovating but we are conservative for risks that could impact our reputation. The illustration below shows the strategic risks plotted under the risk appetite categories. A large proportion of our strategic risks would impact our operational delivery (S1, S4, S12 and S15), or our reputation and credibility (S2, S13, S14 and S17). The remaining four risks would impact our finances (S3), our ability to innovate (S7), our people (S16) and our compliance to legal and regulatory requirements (S11).

Reputation and Credibility

S2 Horizon scanning and resource planning

S13 Failure to manage stakeholders

S14 Planning for the future and Project Speed

S17 Missing opportunities to improve customer experience

Operational Delivery

S1 Capability and capacity

S4 Operational performance

S12 Failure to embed changes

S15 Impact of national infrastructure applications

Innovation

S7 Change in the organisation

Financial

S3 Change projects’ benefit realisation

Compliance, legal or regulatory

S11 Data protection

People

S16 Health, safety & wellbeing

Our risk profile through 2020/21

Our strategic risk profile changed throughout 2020/21. This was due to external events, such as the COVID-19 pandemic or the Planning for the future White Paper, and to internal changes and pressures. The following pages show in detail how each risk score changed and explains the mitigations implemented as well as the ones planned for the future.

We identified four new strategic risks (S14, S15, S16 and S17). We closed one risk, about the Heathrow Project (S10), since S15, one of the newly logged risks, covers Nationally Significant Infrastructure Projects in general. We updated and re-assessed all other risks: one score increased (S12), three risks remained stable overall (S2, S3 and S7) and four risks reduced by the end of the year (S1, S4, S11 and S13). Strategic risks S5, S6, S8 and S9 were closed in previous years. The heat map below shows our strategic risks and how they evolved in 2020/21.

S1 – Capability and capacity

Lack of business-critical people could keep the Inspectorate from meeting the requirements and needs of our customers and stakeholders.

Change in scoring

Risk score in April 2020 – 12

Risk score in March 2021 – 8

The likelihood of this risk occurring reduced.

Mitigations delivered in 2020/21

- Prepared a thorough funding bid to ensure we have the resources needed to meet the demand and deliver our services.

- Developed a learning and development approach for 2020/25 and a 2021/22 plan to ensure our people have the right skills.

- Switched to virtual recruitment methods that allowed us to fill the vast majority of vacant posts and complete our restructure.

Future mitigations

- Develop a five-year workforce plan detailing the size and skill of our current workforce, what we will need in the future, and an action plan for developing those skills.

- Review our latest organisation design to ensure it is fit for

purpose. - Develop key professions with clear professional development pathways.

S2 – Horizon scanning and resource planning

Inability to understand the future planning environment could lead to insufficient numbers of

skilled people, limiting our ability to deliver our public services.

Change in scoring

Risk score in April 2020 – 12

Risk score in March 2021 – 12

No change.

Mitigations delivered in 2020/21

- Liaised with Ministry of Housing, Communities and Local Government and other public bodies to identify possible future changes to policy.

- Developed our capacity and capability to understand external factors through the creation of our horizon scanning function.

Future mitigations

- Develop a five-year workforce plan, detailing the size and skill of our current workforce, what we will need in the future, and an action plan for developing those skills.

- Develop a systematic approach to horizon scanning.

S3 – Change projects’ benefit realisation

Failure to realise benefits from our change projects could keep us from delivering our strategy and

required savings.

Change in scoring

Risk score in April 2020 – 12

Risk score in March 2021 – 12

No change

Mitigations delivered in 2020/21

- Improved project management capacity and capability to

ensure we can fully benefit from each change.

Future mitigations

- Implement controls to systematically track delivery of savings

and benefits. - Promote culture change to enable successful delivery.

S4 – Operational performance

Mismatch between demand for services and our ability to deliver could lead to inability to sustain the level of performance required by our sponsors and customers.

Change in scoring

Risk score in April 2020 – 16

Risk score in March 2021 – 12

The likelihood of this risk occurring reduced.

Mitigations delivered in 2020/21

- Trialled approaches in an ‘experimental team’ to challenge assumptions and behaviours and break down the complexity keeping us from responding to the changes in customers’ demands.

- Revised resourcing models to reliably inform decision-making.

Future mitigations

- Establish a recruitment and training cycle for Inspectors.

- Review the training approach for both new and existing

Inspectors to support increased flexibility. - Review Inspectors specialisms to increase flexibility.

- Develop a five-year workforce plan, detailing the size and skill of our current workforce, what we will need in the future and an action plan for developing those skills.

S7 – Change in the organisation

Resistance to change and lack of change leadership prevent us from doing things differently, achieving our strategic priorities and responding to external pressures.

Change in scoring

Risk score in April 2020 – 12

Risk score in March 2021 – 12

While the likelihood of this risk increased, we were able to decrease its impact. No overall change in score.

Mitigations delivered in 2020/21

- Implemented an ‘agile’ approach for our change projects as well as early engagement. The new services were tested in a controlled live environment.

- Used feedback from the controlled live environment testing to improve service.

- Trained line managers to role model a positive approach to change and to offer support to our people.

Future mitigations

- Build on experience of the pandemic as we have shown that we can respond to change very quickly.

- Implement controls that will encourage flexible use of our people to limit the use of contractors.

S10 – Impact of Heathrow Airport expansion submission

The scale, complexity and profile of the Heathrow Airport expansion could lead us to underestimate the costs and the level of Inspectors’ input required to process the application.

Risk closed

Risk score in April 2020 – 12

Covered as part of risk S15 Impact of Nationally Significant Infrastructure Project applications.

Mitigations delivered in 2020/21

- Secured funding from the Ministry of Housing, Communities and Local Government for project.

- Maintained a dedicated project team to manage and assure our work.

- Included Nationally Significant Infrastructure Projects as part of

the transformation programme.

S11 – Data protection

The lack of robust controls and an immature culture of data governance could lead to a data breach as we fail to comply with our legal and regulatory obligations.

Change in scoring

Risk score in April 2020 – 16

Risk score in March 2021 – 12

The likelihood of this risk occurring reduced.

Mitigations delivered in 2020/21

- Delivered training on general data governance to some of our people prior to the COVID-19 pandemic.

- Delivered specialised training to people with key roles and responsibilities.

- Updated processing activities and information asset register.

- Completed data protection impact assessments.

- Enabled virtual events by carrying out a data protection risk assessment and setting up data sharing agreements.

- Risk assessed all new processing of personal data.

- Improved data sharing agreements for new local plan examinations.

- Updated people and recruitment privacy notice and the casework privacy notice.

Future mitigations

- Continue implementation of the record retention and disposal policy as part of the information management system.

- Deliver e-learning package and additional bespoke training.

- Risk assess historic processing of personal data.

- Put in place data sharing agreements for ongoing data sharing with customers and stakeholders.

S12 – Failure to embed changes

The digital public services developed by the transformation programme are not sufficiently

integrated into our processes and are not developed further after the programme ends.

Change in scoring

Risk score in April 2020 – 12

Risk score in March 2021 – 16

The likelihood of this risk occurring increased.

Mitigations delivered in 2020/21

- Started to implement new ways of working aligned to the service model, in line with the Government’s digital agenda.

Future mitigations

- Update governance processes to support an agile approach.

- Integrate the transformation programme team and their learning with our digital team.

- Embed digital work practices, throughout the Inspectorate, and particularly in the Digital Services team, through a specific project.

S13 – Failure to manage stakeholders

Failure to manage stakeholder relationships and communications or a badly handled error could impact our reputation.

Change in scoring

Risk score in April 2020 – 15

Risk score in March 2021 – 12

The likelihood of this risk occurring reduced.

Mitigations delivered in 2020/21

- Monitored customer feedback through a variety of channels.

- Captured, shared and used insights from monitoring.

- Promoted a strong corporate narrative for our people and proactively communicated to customers and key stakeholders.

- Used a risk-based approach to train our people in areas known to cause significant reputation damage, such as data protection.

Future mitigations

- Develop a stakeholder management strategy.

- Systematically use continuous improvement to solve issues promptly and improve customer experience.

S14 – Planning for the future and Project Speed

Uncertainty, lack of resources, capacity and skills could delay or prevent the implementation of the changes triggered by Planning for the future and Project Speed.

Change in scoring

Risk score in March 2021 – 16

This is a new risk.

Mitigations delivered in 2020/21

- Worked with the Ministry of Housing, Communities and Local Government to give early insights into Planning for the future.

- Worked with key stakeholders to limit policy constraints and to identify the most beneficial changes to the end-to-end delivery as part of Project Speed.

- Secured appropriate resourcing.

Future mitigations

- Project manage our approach using early experience with the pilot applications and risk management.

- Forecast the skills and resource needed (including any transitional phase) and recruit as necessary.

- Design and deliver a training programme.

- Work with stakeholders, Local Planning Authorities and customers to help them be prepared and engaged with us in the new system.

S15 – Impact of Nationally Significant Infrastructure Project applications

The submission of a single, large, complex, high profile and controversial application, or

overlapping of several smaller cases, could surpass our capacity to deliver.

Change in scoring

Risk score in March 2021 – 16

This is a new risk.

Mitigations delivered in 2020/21

- Trained Inspectors to increase capacity.

- Progressed change projects and ensured benefits’ realisation.

- Identified and engaged with key stakeholders to improve forecasting accuracy.

- Involved Inspectors early in the pre-application phase.

- Used Inspectors more flexibly across several applications.

Future mitigations

- Trial changes arising from Project Speed.

S16 – Health, safety and wellbeing

Failure to address health, safety or wellbeing could result in a major accident, incident, near miss or ill health.

Change in scoring

Risk score in March 2021 – 12

This is a new risk.

Mitigations delivered in 2020/21

- Implemented a home working health and safety checklist and a COVID-19 personal risk assessment, providing support and advice to our people as needed.

- Set up social distancing measures in our offices and used

weekly risk assessments to allow our people to work safely. - Provided regular updates of the guidance for site visits.

- Prepared an action plan to improve reporting and strengthen controls following an internal audit and critical friend review.

- Expanded membership of the health, safety and wellbeing committee to represent all our people and Trade Union representatives.

- Developed and updated health, safety and wellbeing approach, policies and procedures and recruited a manager.

Future mitigations

- Roll out updated approach, policy, and procedures.

- Roll out role-specific training on health, safety and wellbeing.

- Review occupational stress and implement an action plan.

- Implement a continuous review of risk assessments, including personal safety, lone working, working at height and visiting construction sites.

- Ensure our office remains COVID-19 secure.

S17 – Missing opportunities to improve customers’ experience

Insufficient focus on innovation, user needs and end-to-end experience could lead us to miss opportunities to transform customers’ experience.

Change in scoring

Risk score in March 2021 – 9

This is a new risk.

Mitigations delivered in 2020/21

- Held change project ‘Show and tells’ to share learning and best practice and encourage embedment within the organisation.

- Considered and implemented good practice from elsewhere in Government to improve assurance and challenge of our approach to change.

Future mitigations

- Develop a systematic approach to horizon scanning.

- Roll out the Customer Strategy and the Innovation Strategy.

Our organisation

Our organisational resilience was tested by the pandemic. We focused on keeping our people safe and supported them as they balanced work with life in lockdown, which often included extra caring responsibilities. We also implemented a new organisational design, improved our engagement and started to improve our inclusivity.

Organisational design

At the same time as we were managing the impact of the pandemic, we implemented the organisational design programme that was prepared in 2019. Two hundred and seventeen people have been either promoted, recruited externally or moved to another role. 50% of our promotions were from internal candidates. Almost 80% of our people are Inspectors or involved directly in delivering our services. The remaining 20% are split between the Corporate Services Directorate (12%) and the Strategy Directorate (8%).

Graph 9. The Inspectorate’s workforce

The impact of the COVID-19 pandemic

We provided proactive health, safety and wellbeing support to our people when we transitioned to home working in March 2020. While the Inspectors were already home based, the rest of the organisation responded by adapting fantastically well to working from home. The pandemic has challenged our people and we supported them as they balanced work with caring responsibilities such as home schooling, caring for relatives but also self-care. We are currently reflecting on the lessons we have learned throughout the pandemic and how this might improve how we work in the future.

Equality, diversity and inclusion

We are shaping our approach to improve equality, diversity and inclusion for our people. Led by our Chief Executive, Sarah Richards, both our established and new networks are gaining confidence to lead change throughout the organisation. We are progressively adopting a different perspective to the way we approach everyday business. We have established a dedicated recruitment team, bringing together specialist skills to attract and retain the right people with the highest quality skills at the right time. This team will be enhancing our apprenticeships and outreach programme to widen our appeal across the communities we are based in.

We have started reviewing our pay strategy and this work will be completed during the next year, addressing the gender pay gap and ensuring our commitment to equal pay will be at the centre of our future strategy.

Learning and development

In 2020, we established a central learning and development function to modernise and develop a consistent approach to learning across our organisation. The pandemic challenged our traditional methods of learning and the new structure allowed for innovation in our delivery. We have met emerging learning needs, established a central learning resource and set out our approach for learning over the next five years, which underpins our People Strategy and Strategic Plan.

Engagement

Our people engagement score in 2020 was 65%, which is two percentage points higher than our 2019 score but still one percentage point behind the Civil Service high performing benchmark.

This result confirms a steady year-on-year improvement trend that started in 2015, when our engagement score was 56%. We hope this increased engagement is the result of our investment in supporting and developing our people and commitments outlined in our People Strategy. Next year our focus will be on leadership and line manager development as well as progressing the implementation of our Equality, Diversity and Inclusion approach.

The creation of the Welsh Inspectorate

A first Planning Inspectorate for the Welsh Government

As planning law in England and Wales continues to diverge, it challenges the operational model of one Inspectorate consistently serving two separate governments, that have competing needs, different social, environmental, economic and planning policies.

Establishing a separate, independent Planning Inspectorate for Wales, has been a topical debate for many years. The current arrangement is a legacy of pre-devolution arrangements, which has continued post devolution with no identified need for change. There has been ongoing political pressure to consider the possibility of a dedicated Welsh Inspectorate. A separate structure will bring Wales into line with the other devolved administrations as Wales is the only devolved administration not to have its own dedicated Inspectorate.

The Welsh Government’s Minister for Housing and Local Government concluded, on 29 March 2019, that officials should begin work to explore options for a separate Welsh Inspectorate. The objectives of the new Inspectorate are to continue determining planning appeals and related casework on behalf of the Welsh Ministers and provide high levels of service to all stakeholders in the system.

The planning system is pivotal in the delivery of the Welsh National Strategies, as it governs what development should take place and where. The new Wales Planning Inspectorate Service will be key in supporting the delivery of a robust planning system.

Casework processed by the new Inspectorate will be of significant importance to the economy in Wales. As well as dealing with a wide variety of planning applications, it will handle casework relating to transport, marine and energy applications.

The Head of the new Inspectorate will need to provide impartial views and advice on the planning process to politicians and practitioners across a range of interests. This role has been pivotal in achieving political and professional culture change within the Welsh planning service before, during and after the creation of the Planning (Wales) Act 2015. The value of the new independent Planning Inspectorate to the Welsh planning service cannot be overstated.

Our three public services

Across our three services, our independent, experienced Inspectors decide cases and make recommendations in an open, fair and impartial way. This means they consider the evidence, make sure everyone can respond to evidence of others and keep an open mind without prejudging one view compared to another.

Examinations service

The places where we live and work significantly affect our lives and wellbeing.

English councils and some other organisations produce local plans and other plans with their communities to identify how they will prepare for the future. We independently assess if the plans meet the legal, procedural and policy tests for them to be used.

The Welsh Government’s commitment to delivering sustainable development is underpinned by local development plans. They contain the strategy, policies and allocations to address key issues in an area, based on robust evidence. We examine those plans to ensure they will provide a solid base to support decision making once they are adopted.

Appeals service

Councils can refuse planning and related applications, and they can fail to make a decision in time or give you an enforcement notice requiring you to do something or stop doing something.

The Inspectorate is here if you want someone independent to consider the decisions from councils. Our Inspectors independently review the information and evidence and, in most cases, visit the site and nearby area before deciding the case.

This service also provides independent Inspectors to consider evidence and make decisions for specialist work including:

- Tree preservation order works, hedgerow removal and anti-social high hedge appeals.

- Public rights of way such as when proposals include changes to access rights to the network or when there are objections to a new right of way.

As part of our transformation programme we conducted extensive user research with appellants, agents and local planning authorities. We used this research to design an Alpha development phase solution. In August 2020, we were able to meet the Government service standard.

Householder appeals have been developed as the first element and launched to a pilot group of local planning authorities. Over the next year, we will make this available to more authorities and also include additional appeal types.

Applications service

National Significantly Infrastructure Projects in England and Wales and Developments of National Significance in Wales

We all use and rely on national infrastructure. We all rely on our power stations and wind farms to generate electricity. We all rely on our major roads, railways, ports and airports to move people, food and other products around the country and between countries. We all rely on reservoirs for fresh water when we turn our taps and sewage treatment works when we flush our toilets.

These are the largest and most complex development projects in the country. They take many years to develop. We provide advice during that period, identifying where the projects need improvement or where more evidence is needed to justify a design decision.

We consider the interests of developers, local authorities, local communities and other interested parties, implement government policy and consider anything else that is relevant. We recommend to the Secretary of State or the Welsh Ministers whether these projects should go ahead.

As part of our transformation programme, we have completed the discovery phase for our applications service and we are now designing an Alpha development phase solution with a focus on Nationally Significant Infrastructure Projects, with a service assessment planned for 2021.

Common land

We also decide other applications for government, like applications for work on common land. Common land has a long history based on ancient rights under British common law and remaining common land is now publicly accessible.

Compulsory purchase orders

Some organisations can purchase land even if the owner does not want to sell. This is normally because the land is needed for an important project like a road, railway or a development important for the area. We independently assess whether the compulsory purchase order should go ahead.

Our quality assurance process

The quality of our work is important to maintain the confidence of all those involved in planning, including the Public, politicians and developers. By quality we mean everything relating to the content of the final decision and the procedures and processes that lead up to that.

Individual Inspectors are responsible for the decisions and recommendations they make, and are ultimately responsible for the quality of their own work. As an organisation, how do we support them to achieve the right quality?

This will vary depending on the type of work, but it all starts with the training we provide for new Inspectors. It focuses on the importance of weighing up opposing views to reach well-justified conclusions and on the application of the Franks Principles – open, fair and impartial.

Beyond this, the Inspectorate is responsible for providing training, quality assurance processes and knowledge management. We provide all Inspectors with a monthly update of key developments in the planning world including about significant legal judgments and policy matters.

Examinations

All Inspectors new to local plan work receive training backed by written advice about process and best practice. Training, advice and briefings are provided at two specific events each year and more regularly as needed, for example through monthly meetings. These allow good practice to be shared and discussed.

All local plan reports and soundness letters are quality assured by a panel. Quality assurance is focused on the standard of the reasoning and drafting and Inspectors are never told what conclusions they should reach. Quality is also considered at monthly line manager meetings and in monthly conversations with Inspectors. We regularly consider the outcomes of the quality assurance process, legal challenges and complaints to assess whether we need to change anything.

Appeals

Most Inspectors decide planning or enforcement appeals at some point during their careers. The initial training is rigorous and extensive and covers the key principles for decision-makers. Guidance is provided on the approach that should be taken, having regard to legislation, policy and case law. However, we do not provide anything more than is in national policy and guidance regarding the importance to be given to relevant considerations. The outcome of any appeal is a matter for the individual Inspector’s judgement.

Training on specific topics and a legal update is delivered at twice yearly events. This often involves sharing good practice and experience. Training materials are also used in smaller meetings and in webinars.

In England, a sample of appeal decisions are reviewed by line managers after they have been issued and feedback is given. We circulate any lessons that arise from complaints or challenges to all Inspectors. In Wales all decisions are checked before issue to ensure that factual matters such as the case reference, and plan numbers are correct.

In some cases, appeals are decided by the Secretary of State or the Welsh Ministers rather than by the Inspector. In these cases the Inspector’s report is reviewed by a quality assurance panel before submission. This review focuses on the standard of the reasoning and drafting, rather than on what recommendations an Inspector should make.

Applications

Quality assurance for applications is a similar process to that of examinations and appeals. Comprehensive initial training takes place to ensure Inspectors are ready to examine, assess and make recommendations. There are two main training events each year and regular updates take place on best practice and matters of policy and law. All reports are quality assured on drafting and reasoning, and not on the nature of the recommendation the Examination Panel make.

Our operations

Our Inspectors use three different procedures to consider evidence. The approach they use depends on the case, the type of evidence and how they can best find out what they need to make their decision or recommendation.

Adapting operations to the pandemic

While we maintained a high level of performance in Wales, in 2019/20 we significantly improved our operational performance in England. We decided many more cases than we received, and our decisions were getting faster (see our performance analysis). We planned to continue that progress in 2020/21 but the COVID-19 pandemic impacted our operations and priorities.

Keeping our employees and customers safe was our immediate priority. We then focused on keeping casework moving where it was safe to do so and supporting the Ministry of Housing, Communities and Local Government as part of the wider government response.

In March 2020, we paused visiting appeal sites and postponed all hearings and inquiries. In the

first six weeks of the spring 2020 lockdown we successfully:

- Issued decisions where site visits had already taken place;

- Trialled issuing decisions without visiting the site in some cases;

- Prepared to re-start hearings and inquiries virtually;

- Prepared to re-start site visits safely when travel was permitted; and

- Seconded 30 Inspectors to the Ministry of Housing, Communities and Local Government support the wider government response.

Throughout the rest of the year, we adapted how we work and supported our employees with their shielding and caring responsibilities. Safe site visits re-started in mid-May. Hearings and inquiries re-started virtually. We have now held more than 700 events using Microsoft Teams and Youtube to connect with all relevant parties. We made over 17,500 recommendations and decisions on examinations, appeals and applications during the year.

Written representations

Most of our cases are decided by Inspectors after seeing written evidence and usually visiting the site. This is often called “written representations”. The appellant, the Council, local people and businesses and anyone else interested in the appeal make their comments in writing and the Inspector decides the case after reviewing the evidence.

Hearings

Our national infrastructure applications, local plan examinations and some appeal cases are decided after the Inspector has held a hearing. In these cases the appellant or applicant, the Council, local people and businesses and anyone else interested in the case make their comments in writing. The Inspector then chairs a structured discussion around some or all of the issues to help them test the evidence. Hearings for applications and examinations can take place over days or weeks, but hearings for appeals cases are much shorter. Inspectors often visit the site as well, and then prepare their decision or recommendation.

Inquiries

Inquiries are held for the most complex appeals and for some other casework like compulsory purchase orders and called in planning applications. The appellant or applicant, the Council, local people and businesses and anyone else interested in the case also make their comments in writing. At the discretion of the Inspector, people can also make their views known verbally at the inquiry. Inquiries are more formal than hearings and evidence is tested by cross examination, normally by barristers representing the main parties interested in the appeal. After visiting the site, the Inspector then makes their decision or recommendation.

Inspectors have historically used one of the three procedures for the entirety of a case. Legal changes now make it clear that Inspectors can use more that one procedure on a single case, we call these hybrid procedures.

Examining local plans in England

Local plans continued to be prepared and submitted to us through the year. We examined them virtually so that these important plans for local communities and the economy were not delayed.

Twenty-four plans were submitted to us for examination this year, a fall of 12 compared to 2019/20. This is fewer than were expected at the beginning of the year, with the COVID-19 pandemic being the likely biggest factor in plans progressing more slowly than councils had expected. Our income decreased significantly to £2.6 million in 2020/21, the lowest it has been since at least 2016.

We held 72 virtual events so that the plans would not be delayed by lockdown measures and issued 32 reports on local plans we examined. All our reports concluded that the Duty to Co-operate had been met by local planning authorities. The Duty to Co-operate is a legal requirement of local planning authorities in the way they prepare their plans. In these cases the plan cannot continue as it is about the way the plan has been prepared, not the content of the plan itself. In all cases our reports recommended changes to improve soundness and pass the legal, procedural and policy tests. Sometimes this meant removing unjustified policies or introducing new ones, amending the wording of a policy or changing a housing requirement. We worked pragmatically and constructively to help them achieve this. The planning authorities (normally councils) were then able to adopt their plans and start making positive changes for their communities even during a pandemic.

Graph 10. Local Plans received and issued

Local Plans across England provide for 3.7 million homes

Source: https://local-plans-prototype. herokuapp.com/

Local plan housing requirement data reflects the Ministry of Housing, Communities and Local Government’s understanding of adopted plans as at the end of December 2020. The data is experimental, updated monthly, and is subject to limited validation. It therefore shouldn’t be relied upon as a reliable ‘real-time’ representation of local plan progress or content.

South Oxfordshire Local Plan – A case study

South Oxfordshire is the first plan examination in which all the hearings were conducted virtually. It had a high level of public interest. The hearings were livestreamed on our YouTube channel.

South Oxfordshire is a district that extends south-eastwards from Oxford, as far as the northern fringes of Reading, taking in a substantial part of the Oxford Green Belt and the Chiltern Hills Area of Outstanding Natural Beauty, and a smaller area of the North Wessex Downs Area of Outstanding Natural Beauty. The District contains the attractive and thriving market towns of Wallingford, Thame and Henley-on-Thames, the expanding garden town of Didcot, a range of different villages, and much pleasant open countryside.

South Oxfordshire, the City of Oxford, and the County of Oxfordshire have a strong and growing economy, but housing is not affordable for many. South Oxfordshire has a significant need for all kinds of housing, including affordable housing, and the neighbouring city of Oxford is unable to accommodate all its own housing need within its boundaries. There are also some significant infrastructure issues to address.

The South Oxfordshire Local Plan sets out how development will be planned and delivered across South Oxfordshire until 2035. It identifies appropriate areas and sites for new development, such as new homes, shops and community facilities. It sets out how valuable historic and natural environments will be protected and enhanced. The policies in the plan will help make decisions on planning applications in the District until it is replaced.

The Council started developing the plan in 2014 and supported it with a detailed evidence base consisting of 18 studies and plans. The Council undertook numerous public consultations as part of developing the plan and the evidence base.

The Local Plan was submitted to the Planning Inspectorate for examination on 29 March 2019, but on 3 October 2019, the Council’s Cabinet decided to recommend withdrawing it. Various interventions from the Secretary of State followed, with the last one just two weeks before the spring 2020 lockdown. On 3 March 2020 the Secretary of State issued new directions to the Council, including that it should progress the plan through examination.

With the spring 2020 lockdown, along with likely continued restrictions in the following months, it was clear that the normal approach to local plan examination was not possible. The Council’s offices were closed, as were other meeting venues. Large meetings of people from different households was not safe and often not allowed.

With the Council’s co-operation we agreed the hearings would be the first to be fully undertaken virtually and it would be livestreamed over the internet. Although many people are now used to using video technology, far fewer were familiar in spring 2020. Could it be done?

The Council acted swiftly by providing responses to the Inspector’s comments and questions through April and May 2020. At the same time preparations were in full swing behind the scenes. The technology needed to be set up and tested for such a large scale event. Guidance for all those taking part was prepared. Measures were tested to make sure participants weren’t prejudiced, including being able to join the meeting from a range of computers, phones and tablets with different browsers. Data privacy requirements were designed into the process. We also needed to ensure the Inspector could join the virtual meeting without sharing his contact details, ensuring he remained impartial and everyone was seeing the same evidence.

With co-operation from the Council, the Programme Officer and a team effort from across the Inspectorate, the Inspector opened the examination on 14 July 2020. It ended on 7 August 2020 with 469 witness appearances and 15,203 YouTube views.

The virtual hearings were conducted in a very similar way to physical hearings. The Inspector was able to gain all the information they needed, and at the end of the examination they found the plan sound, subject to a list of modifications. The Council agreed to incorporate the recommended modifications into the plan, and the plan was adopted in December 2020.

There were no direct complaints about the virtual format after the event. Feedback from the Council was very positive with the virtual format and they added that they would not want to go back to physical hearings for a local plan examination. The District now has an up-to-date Local Plan to guide and manage development despite the impact of the pandemic. The plan provides for 23,550 homes with seven strategic housing sites and 12,403 jobs with up to 47.64 hectares of employment land.

Appeals in England

We have successfully kept casework moving through the pandemic by working differently.

The lockdown’s restrictions and our reduced capacity through the year have affected our customers’ experience, particularly for hearings and inquiries. However, our overall decision times were improving by the last quarter.

We receive a wide range of appeals, as shown in Graph 14, but we group them in three categories, detailed below from the most to the least common.

Planning appeals

This is our largest area of work. Despite the pandemic, new planning appeals being submitted remained high, only around 7% lower than 2019/20.

We decided fewer appeals than we received through spring and early summer 2020. This is the result of suspending site visits, hearings and inquiries during spring to keep our employees and customers safe. We also had reduced Inspectors’ capacity due to shielding and caring activities through the year. Putting in place virtual hearings and inquiries as well as changes to safely conduct site visits allowed us to keep on top of the overall number of new cases being submitted during the early 2021 lockdown.

Enforcement appeals

We received 21% less enforcement appeals compared to 2019/20. This could be because fewer enforcement notices were served by councils while they focused on COVID-19 pandemic related priorities.

In 2019/20, we were able to consider a high number of enforcement appeals. Before we were able to see the effect of our efforts in 2020/21, site visits, hearings and inquiries were suspended reducing our ability to make decisions. We were able to limit the increase in the numbers of open cases through the year, putting us in a good position to reduce decision times for hearings and inquiries next year.

Specialist appeals

Specialist casework dealt with by our appeals service includes works to protected trees by a tree preservation order, environmental, hedgerow regulation and high hedge appeals and a range of casework relating to public rights of way.

New cases received were 8% lower than 2019/20. The biggest fall (around 40%) was in rights of way casework. This could also be because councils focused on pandemic related priorities and reduced rights of way activities.

Graph 11. Appeal cases decided by quarter in 2020/21

Graph 12. Appeal cases decided by type in 2020/21

| Type of appeals | Cases decided in 2020/21 |

|---|---|

| Planning appeals | 9,121 |

| Planning appeals – Householder | 4,155 |

| Enforcement appeals – Enforcement notice | 1,645 |

| Enforcement appeals – Lawful development certificate | 552 |

| Planning appeals – Commercial appeal | 367 |

| Planning appeals – Listed building consent and conservation area consent appeal | 365 |

| Specialist appeals – Tree preservation order | 289 |

| Specialist appeals – Rights of Way appeals, directions and modifications | 184 |

| Planning appeals – Advert | 60 |

| Enforcement appeals – Listed building notice and enforcement conservation area notice | 51 |

| Specialist appeals – High hedges | 50 |

| Planning appeals – Called-in planning applications | 11 |

| Planning appeals – Section 106 agreement | 7 |

| Specialist appeals – Environment and hedgerow | 6 |

Planning appeals decided by written representations

Appeals were held up during the Spring 2020 lockdown. This led to customers experiencing a longer wait for decisions during summer and autumn. As restrictions were lifted, our Inspectors’ availability increased and site visits became possible again, and we made good progress in deciding cases which built up earlier in the year. We steadily improved back to pre-pandemic speeds during winter. We improved our consistency this year and we decided 90% of our cases within 37 weeks, four weeks faster than last year. But there were fewer very quick decisions, with 10% of cases decided in 13 weeks rather than 12; and the median decision time rising from 19 weeks to 22.

Graph 13. Median decision time for planning appeal cases decided by written representations

Planning appeals decided after hearings

Previously, hearings were hosted by local planning authorities in their buildings and took place in person, so they were postponed at the start of the Spring 2020 lockdown. Virtual hearings allowed us to continue our work despite the COVID-19 pandemic but we had to organise and host them ourselves instead of relying on local planning authorities.

We are now holding around 50 planning appeals by virtual hearing every month, but we need to increase this further to meet demand. We are sharing our learning with local planning authorities so they can once again organise and host hearings. This will help us increase the number of hearings back to pre-pandemic levels and speed up decisions.

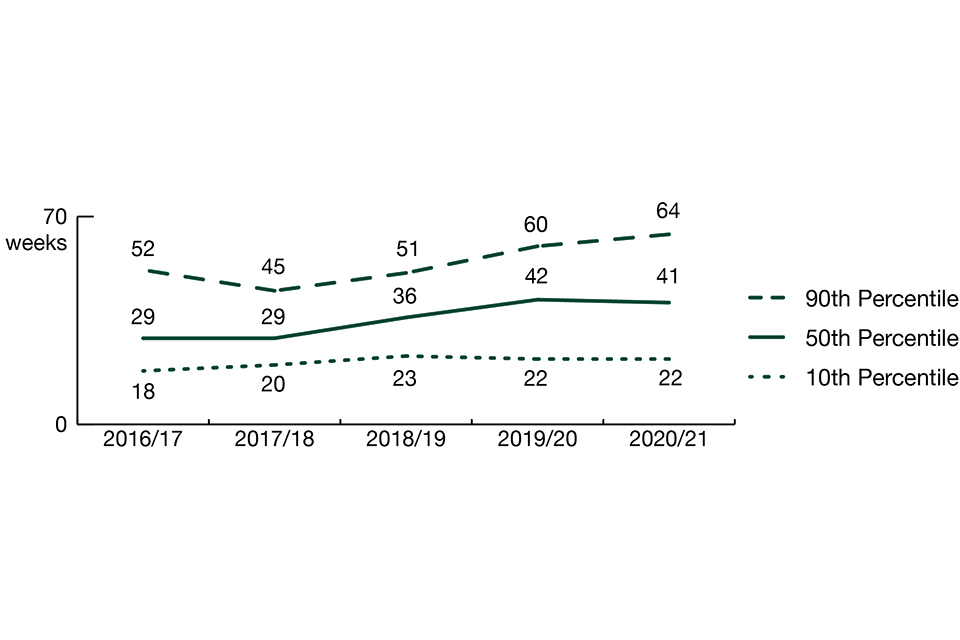

In consequence, some cases took longer to decide than the year before, with 10% taking more than 64 weeks, and our consistency worsened. However we were able to decide as many cases quickly, and even reduce our median decision time by a week compared with the year before Graph 14 . Median decision time for planning appeal cases decided by hearings

Graph 14. Median decision time for planning appeal cases decided by hearings

Planning appeals decided after inquiries

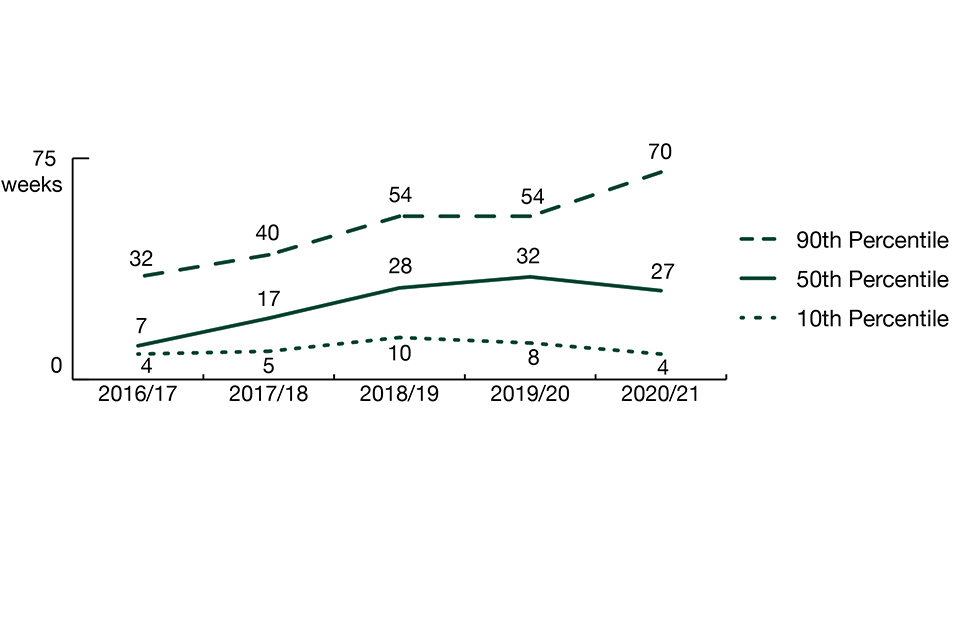

Like planning appeals by hearing, inquiries were postponed during the Spring 2020 lockdown. We have been holding them virtually since June 2020. In early 2021, the high number of inquiries being held virtually should have further reduced decision times, but the winter lockdown reduced our capacity again. Despite those limits on our capacity, we improved our consistency this year and we decided 90% of our cases within 66 weeks, eight weeks faster than last year. But it took slightly longer to decide the quickest cases compared to last year.

Graph 15. Median decision time for planning appeal cases decided by inquiries

Enforcement appeals decided by written representations

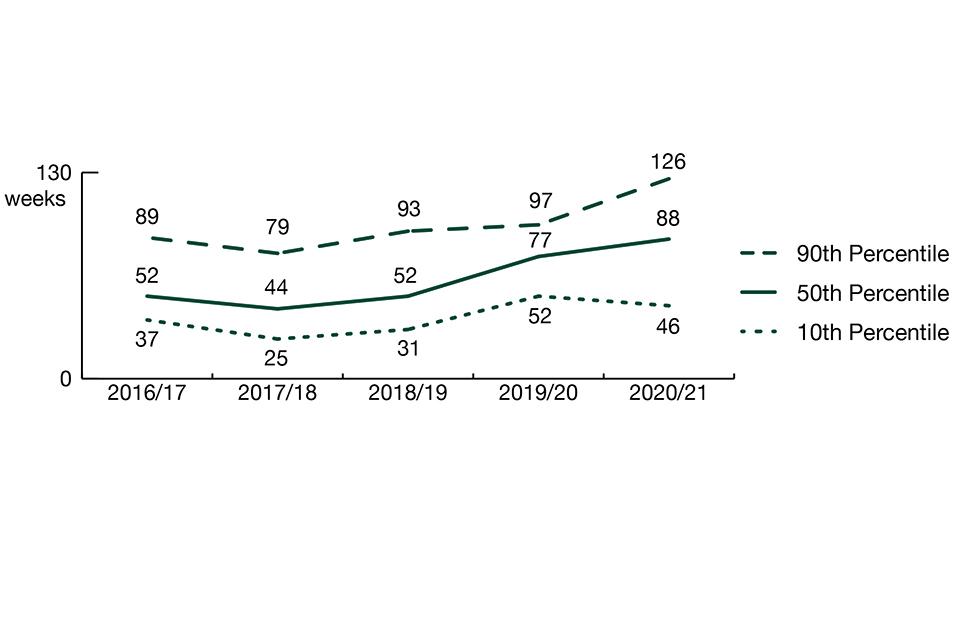

We have reduced the number of open appeals by around 300 or about 11% over the year. As with planning appeals, enforcement appeals were held up during the Spring 2020 lockdown. This led to customers experiencing a longer wait for decisions during summer and autumn. As restrictions were lifted, our Inspectors’ availability increased and site visits became possible again, we made good progress in deciding cases which built up earlier in the year. We improved steadily back to pre-pandemic speeds during winter. In consequence, our decision time for the slowest cases increased by two weeks to 60 weeks, and our overall consistency worsened. However, we were able to improve our decision time for the 10% quickest cases, with decisions being made a week faster compared to last year, and our median decision time was six weeks faster.

Graph 16. Median decision time for enforcement appeal cases decided by written representations

Enforcement appeals decided after hearings and inquiries