UK business & economy updates

Sign up to myFT Daily Digest to be the first to know about UK business & economy news.

The UK economic rebound slowed to a crawl in July as a surge in the Delta variant of coronavirus forced workers to self-isolate and consumers spent less, raising doubts over the strength of the recovery.

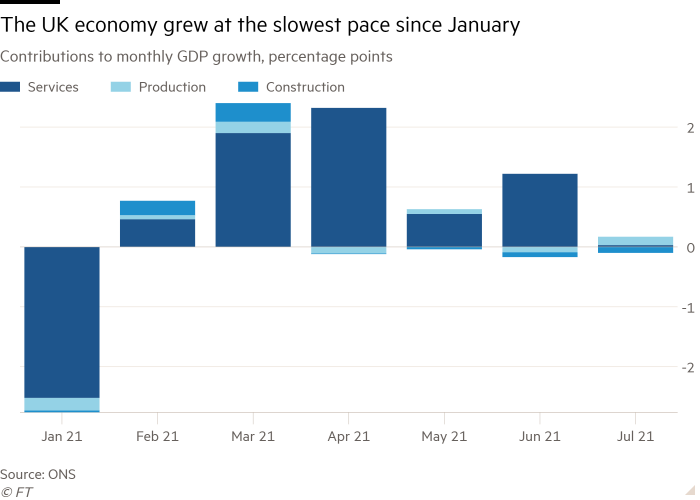

Output rose just 0.1 per cent in July on the previous month, the Office for National Statistics said on Friday, well below the 1 per cent expansion in June and weaker than the 0.6 per cent growth forecast in a Reuters poll of economists.

It was the weakest monthly performance since January and left gross domestic product, or GDP, 2.1 per cent below February 2020 levels, the last full month before the pandemic hit.

“The recovery is now entering a tougher phase,” said Andrew Goodwin, chief UK economist at Oxford Economics. Many risks remained in the coming months, he said, including the scaling back of government support and shortages of components and labour that would represent a growing constraint on activity.

The economy would have contracted if it was not for a 22 per cent expansion in mining and quarrying, boosted by the reopening of an oilfield after a temporary closure for maintenance.

“After many months during which the economy grew strongly, making up much of the lost ground from the pandemic, there was little growth overall in July,” said Jonathan Athow, ONS’s deputy national statistician for economic statistics.

Output in consumer-facing services fell 0.3 per cent in July. This was the first decline since January, mainly because of a 2.5 per cent drop in retail sales due to a spell of bad weather and a spike in coronavirus infections in mid-July that caused the so-called “pingdemic”, after the NHS Covid-19 app ordered hundreds of thousands to self-isolate.

The economic recovery “effectively was stopped in its tracks by the surge in Covid-19 cases in July”, said Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

Since July, rules on self-isolation have been relaxed, while restaurant bookings and visits to shops, bars and restaurants have increased, pointing to a renewed expansion in some services. However, disruption to supply chains, the other main drag on growth, has intensified in August, according to a closely watched business survey.

Output in legal services contracted sharply in July. Kitty Ussher, chief economist at the Institute of Directors, said the dip in the legal, real estate and professional services sector reflected the partial ending of the stamp duty holiday at the end of June that caused a spike in completions ahead of the deadline.

Rising costs and shortages of materials hit the construction sector for a fourth consecutive month, with output down 1.6 per cent, Athow said.

Manufacturing was also flat, with sharp monthly drops in the production of machinery and equipment that offset a rebound in hard-hit car production.

However, Dean Turner, economist at UBS Wealth Management, said he doubted that Friday’s GDP figures would “dent the Bank of England’s hawkish mood” and that he still expected an interest rate rise in the first half of next year.

ONS data also showed that July goods exports to the EU, the UK’s biggest trading partner, fell 6.5 per cent compared with the previous month, in sharp contrast with a 5 per cent expansion for exports to countries outside the trade bloc.

Ana Boata, head of macroeconomic research at Euler Hermes, warned that beyond the fall in exports to the EU, Brexit has also “doubled the UK’s dependency on Chinese imports, which brings with it production risks” given the strains on global supply chains.

“These are predominantly made up of inputs like plastics and textiles which could lead to shortages of many consumer goods if the issues facing global trade persist,” she said.

The return to the office

We want to hear from readers about plans for returning to their workplace. Are you under pressure to go back or are you looking forward to seeing colleagues? Tell us about your plans via this survey.

Credit: Source link