lmost two years after the first cases of Covid-19 were being reported the pandemic has created a new breed of London property hotspots, as well as some glacial cold-spots.

Despite the much-vaunted exodus to the countryside and coast a new study published today reveals that billions of pounds worth of property has been changing hands in leafy London villages.

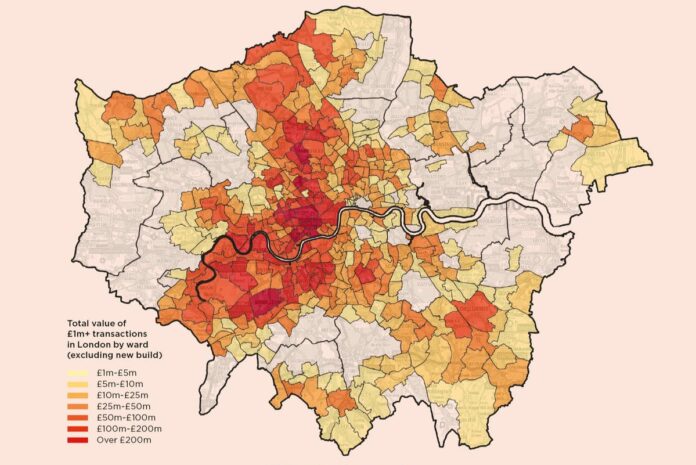

The report, by Savills, shows that since July 2020 the number of agreed sales in London has consistently been above normal levels, in part thanks to the Stamp Duty holiday. In the £1m-plus market, sales have been 46 per cent above average.

What has changed, however, is what buyers want, and where they want it.

When the first lockdown was announced Alex Lyle, director at Antony Roberts estate agents in East Sheen, was “very anxious”. “Everything ground to a shuddering halt, and the level of fall throughs was very high,” he said. “We were stopped in our tracks.”

A couple of months later Lyle noticed that his phone had started ringing. “People had got their heads around how their lifestyles were changing,” he said. “They didn’t want to be in a little flat in central London anymore. And then, of course, the market just roared back into life.”

The same phenomenon was being observed across London and Savills’ report found that house sales, meanwhile, accounted for some 80 per cent of the total money spent on property between June 2020 and 2021.

Demand, it found, was particularly strong in affluent urban villages like Wimbledon, Richmond and Chiswick.

Buyers rang up £1bn worth of sales in two boroughs in the last year: Wandsworth and Richmond upon Thames as they competed for homes in hotspots include Wandsworth Common, Barnes and East Sheen.

The price of properties with five or more bedrooms in prime south west and west London neighbourhoods boomed during the pandemic – up 7.3 per cent between the third quarter of last year and the same period this year. Meanwhile, across London, prices rose by a modest 2.4 per cent.

Lyle said a house which might have sold for £2m in Sheen pre pandemic would now command a price of around £2.25m – providing it was close to Richmond Park, in a quiet street, and ideally within a short walk of the station and in the catchment area of a good primary school. Buyers are often moving out of flats in South Kensington and Chelsea and have opted for East Sheen because it offers comparatively good value compared to more expensive options like Barnes. “Those houses are achieving record prices,” he said.

As Londoners return to the office and the centre of the city revives Lyle believes that the level of demand will simmer down, but he suspects that the pandemic will have a long term impact on buyer priorities. “I think it that open space, a bigger house, is the natural way people want to live now,” he said.

At the other end of the spectrum sales of flats flagged during the pandemic – Savills found that almost £3.49 billion was spent on London flats (worth £1 million or more) between May 2018 and May 2019. The following year this number dropped to £3.25 billion.

Looking forward, and with travel restrictions loosened, Savills expects demand for flats across London to increase as international buyers and office workers return. This should be good news for locations like Canary Wharf and Wapping.

James Hyman, head of residential at Cluttons, said the market for modern flats in Canary Wharf had flatlined during the pandemic. “Party because of the mass exodus from the office, and partly because of …. [blocks caught up in the cladding crisis] … Canary Wharf has understandably really, really struggled,” he said.

With interest rates at a record low most buyers have, said Hyman, opted to hang on rather than sell at a discount – indeed, according to Rightmove, the average price of a flat in E14 stood at £504,000, compared to £494,000 today.

“It is a ludicrous time to sell,” he said.

He hopes that as office workers return so will demand for flats in the area. “We may not get so many first time buyers, because they might want to move further out than they would have done pre-Covid-19, but what we will see instead is the return of the pied a terre market from people who have moved their main home out of London,” he said.

Credit: Source link